Right Now

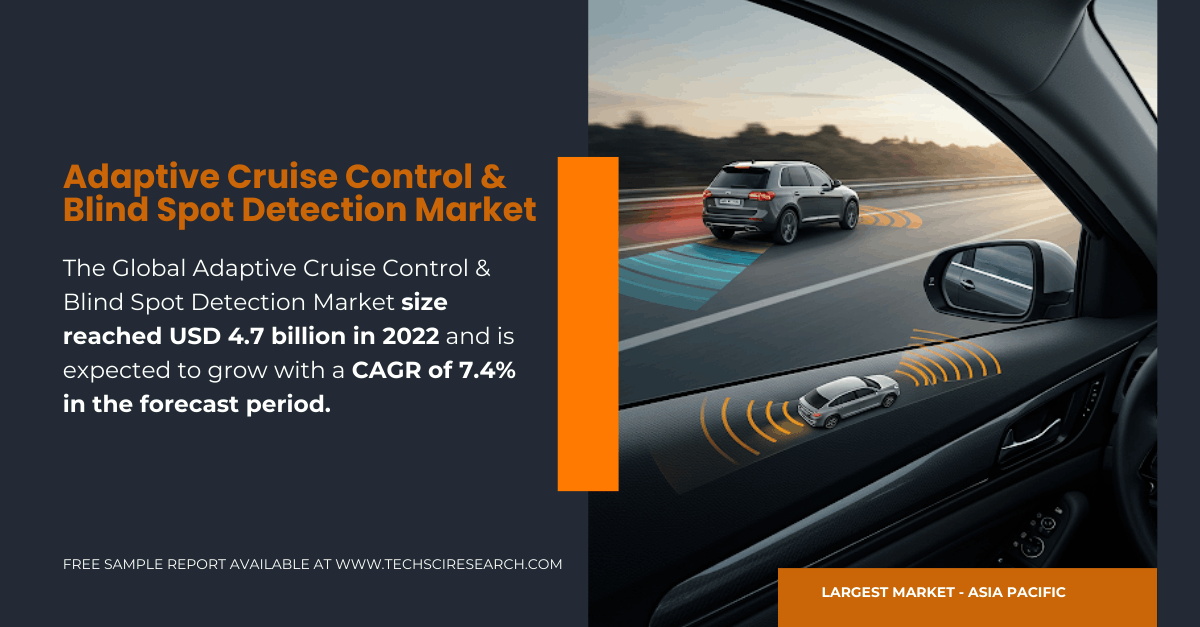

Adaptive Cruise Control & Blind Spot Detection Market Reached USD 4.7B – Demand & [7.4% CAGR] Trends

The global Adaptive Cruise Control (ACC) and Blind Spot Detection (BSD) Market was valued at USD 4.7 billion in 2022 and is anticipated to grow at a CAGR of 7.4% during the forecast period 2024–2028. This growth is being driven by the confluence of rising consumer awareness about safety technologies, tightening global vehicle safety regulations, advancements in autonomous driving technologies, and the automotive industry's strategic push toward developing intelligent mobility solutions.

ACC and BSD systems are becoming foundational elements of advanced driver assistance systems (ADAS), catering to both passenger and commercial vehicle segments.

Adaptive Cruise Control & Blind Spot Detection Market Overview

The Rise of Advanced Driver Assistance Systems (ADAS)

The evolution of the global automotive landscape has seen ADAS technologies rapidly gaining ground, driven by the increasing demand for safer and more convenient driving experiences. Among the various ADAS components, ACC and BSD have emerged as key contributors to this transition. These systems not only mitigate risks associated with human errors but also pave the way for semi-autonomous and autonomous driving functionalities.

Definition and Functionality

Adaptive Cruise Control (ACC): Utilizes sensors like radar and cameras to maintain a safe following distance from the vehicle ahead by automatically adjusting speed.

Blind Spot Detection (BSD): Alerts drivers of vehicles or objects in adjacent lanes that may not be visible in side-view mirrors, improving lane-change safety.

Browse over XX market data Figures spread through XX Pages and an in-depth TOC on "Global Adaptive Cruise Control & Blind Spot Detection Market” @ https://www.techsciresearch.com/report/adaptive-cruise-control-and-blind-spot-detection-market/16383.html

Adaptive Cruise Control & Blind Spot Detection Market Dynamics

Key Growth Drivers

1. Stringent Government Regulations for Vehicle Safety

Many governments have mandated the inclusion of ADAS features in new vehicles, especially in developed countries. Initiatives like Euro NCAP (Europe), NHTSA’s New Car Assessment Program (U.S.), and Bharat NCAP (India) emphasize the importance of safety ratings that encourage OEMs to incorporate ACC and BSD systems into more vehicle models.

2. Rising Consumer Awareness and Demand for Enhanced Safety

Today's consumers are well-informed and increasingly prioritize vehicles equipped with smart safety technologies. This has translated into growing demand across both luxury and mid-range vehicle segments.

3. Technological Advancements and Cost Optimization

Continuous innovations in radar, lidar, and camera systems, along with the integration of AI-based decision-making modules, are leading to more robust and cost-effective ACC and BSD solutions. These developments are enabling mass-market adoption.

4. Integration with Connected and Autonomous Vehicle Platforms

ACC and BSD systems form the core of SAE Level 2 and Level 3 autonomous capabilities. As automakers move toward connected and self-driving vehicle solutions, the demand for these systems is expected to increase significantly.

Challenges and Restraints

While costs are declining, the high upfront investment in components and calibration for ACC and BSD systems, especially for aftermarket installations, remains a barrier for price-sensitive markets. The effectiveness of ACC and BSD systems depends on well-marked roads, consistent traffic behavior, and supporting infrastructure—conditions often lacking in emerging markets.

The integration of ACC and BSD with other vehicle subsystems (e.g., braking, steering, infotainment) requires significant expertise and robust software-hardware synchronization, posing challenges for Tier 2 and Tier 3 suppliers.

Adaptive Cruise Control & Blind Spot Detection Market Segmentation Analysis

By Type

Adaptive Cruise Control (ACC)

ACC dominates the market owing to its broader integration in mid-to-premium segment vehicles and its role in achieving partial automation. The growing popularity of highway driving assistance features in vehicles is propelling ACC integration.

Blind Spot Detection (BSD)

BSD adoption is accelerating due to its lower cost and increasing availability in entry-level vehicle trims. The feature is highly effective in reducing side-collision risks and is now offered as a standard feature by several OEMs.

By Vehicle Type

Passenger Cars

Passenger cars constitute the largest share of the ACC and BSD market. Growing urbanization, increased spending on vehicle upgrades, and safety-focused buying behavior in this segment are key growth contributors.

Commercial Vehicles

Adoption in commercial vehicles is growing, especially in logistics fleets, due to the need to minimize collision risks and reduce insurance premiums. Advanced safety systems are being increasingly specified in buses, vans, and heavy-duty trucks.

By Sales Channel

OEM (Original Equipment Manufacturer)

The OEM segment dominates due to increased factory-fitment of ACC and BSD technologies in new vehicle models. OEMs are collaborating with Tier 1 suppliers to create brand-differentiated ADAS solutions.

Aftermarket

The aftermarket segment is growing steadily, particularly in regions with aging vehicle fleets. Retrofitting BSD sensors and ACC kits has become more accessible through partnerships with local workshops and electronics providers.

Regional Insights of Adaptive Cruise Control & Blind Spot Detection Market

North America, particularly the United States, is a mature and technologically advanced market. The NHTSA and Insurance Institute for Highway Safety (IIHS) are strong proponents of ADAS, promoting these technologies through incentive programs and safety ratings. The region also has robust vehicle connectivity infrastructure, which supports ACC/BSD functionality.

Europe continues to lead in automotive innovation, with a strong regulatory push for ADAS integration under the European General Safety Regulation. German automakers like BMW, Audi, and Mercedes-Benz are at the forefront of integrating advanced ACC/BSD systems with electric and hybrid platforms. Additionally, countries like Sweden and the Netherlands are pilot regions for autonomous driving, further boosting demand.

Asia-Pacific is the fastest-growing market. China, the world’s largest automotive market, has witnessed rapid electrification and adoption of ADAS technologies driven by government incentives and consumer tech-savviness. Japanese OEMs (e.g., Toyota, Honda) are advancing the integration of ACC/BSD systems even in budget segments, while South Korea is fostering smart mobility ecosystems supported by companies like Hyundai and Kia.

Brazil and Mexico are leading adopters of vehicle safety systems in Latin America. While economic challenges persist, safety-conscious urban consumers and supportive government regulations are laying the groundwork for future growth in ACC and BSD technologies.

The Middle East, especially the UAE and Saudi Arabia, is witnessing a growing luxury car market, where ACC and BSD come as standard. Meanwhile, South Africa represents a strategic hub with local assembly lines and regulatory trends favoring enhanced vehicle safety systems.

Technology Landscape

Sensor Technologies

Radar: Core component for ACC, capable of detecting object distance and speed.

Lidar: Gaining momentum for BSD due to superior resolution.

Cameras: Essential for object recognition and classification.

Ultrasonic Sensors: Commonly used in BSD systems for near-range detection.

Artificial Intelligence and Machine Learning

AI is enhancing the real-time decision-making capabilities of ACC and BSD systems. ML algorithms are being trained on vast datasets to improve predictive analysis, system calibration, and performance under varying road conditions.

Human-Machine Interface (HMI)

The evolution of HMI is playing a crucial role in driver engagement and system usability. Real-time visual and audio alerts, tactile feedback, and integration with infotainment systems are ensuring seamless communication between technology and driver.

Competitive Landscape

Major Players

Continental AG

Delphi Technologies PLC

DENSO Corp

Autoliv Inc.

Magna International

WABCO Vehicle Control Services

Robert Bosch GmbH

ZF Friedrichshafen AG

Bendix Commercial Vehicle Systems LLC (Knorr-Bremse AG)

Mobileye

These players are investing heavily in R&D to develop advanced, cost-effective solutions that can be scaled across vehicle types and markets. Collaborations, mergers, and acquisitions are common strategies to expand technological capabilities and geographic reach.

Download Free Sample Report @ https://www.techsciresearch.com/sample-report.aspx?cid=16383

Customers can also request 10% free customization on this report.

Recent Developments

Nanjing Chuhang Tech Co., Ltd., in July 2022, partnered with Leapmotor to equip its new sedan model with front and blind spot 77GHz radar sensors, strengthening autonomous driving capabilities.

Nissan Australia, in May 2022, launched the fourth-generation X-TRAIL featuring standard blind spot warning and intervention, intelligent emergency braking, and rear cross-traffic alert on all trims.

Future Outlook

Market Forecast and Opportunities

The global market for ACC and BSD is expected to grow robustly, driven by:

The rollout of fully autonomous driving ecosystems.

Integration with vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication systems.

Government-funded smart road infrastructure initiatives.

Increasing vehicle electrification requiring modular ADAS integration.

Strategic Recommendations

OEMs should focus on democratizing ACC and BSD features across mid and budget vehicle segments.

Suppliers must innovate sensor fusion technologies that offer accuracy and redundancy.

Governments should continue promoting consumer awareness and safety-centric incentives.

Aftermarket Players can capitalize on the growing interest in retrofitting safety technologies.

Conclusion

The Global Adaptive Cruise Control & Blind Spot Detection Market is evolving rapidly as part of the larger transformation toward safer, more intelligent, and connected mobility. With rising safety concerns, favorable regulations, and continuous technological progress, the market is poised for sustained growth across all major regions.

Stakeholders, including OEMs, suppliers, and policymakers, must collaboratively address challenges like cost, infrastructure, and system interoperability to ensure that these life-saving technologies are accessible and effective for all.

You may also read:

Passenger Car Automatic Transmission Market Trends, Key Players, and {6.9%} CAGR Forecast

Passenger Cars Shared Mobility Market: USD 93 Billion Valuation & {10.7%} CAGR – Key [Trends] & Insights

Automotive Automatic Transmission Market Share and Growth Forecast with {4.5%} CAGR

High Performance Passenger Car Tire Market Overview: USD 38.5 Billion and Projected {6.7}% CAGR Growth

Passenger Car Anti-Fog Lights Market Analysis: Projected Growth at [12.8% CAGR]

More Posts

Report This Post

Please complete the following requested information to flag this post and report abuse, or offensive content. Your report will be reviewed within 24 hours. We will take appropriate action as described in Findit terms of use.