Right Now

Commercial Vehicles Cybersecurity Market Report: Key Players and Market Trends [USD 5.02 Billion by 2029]

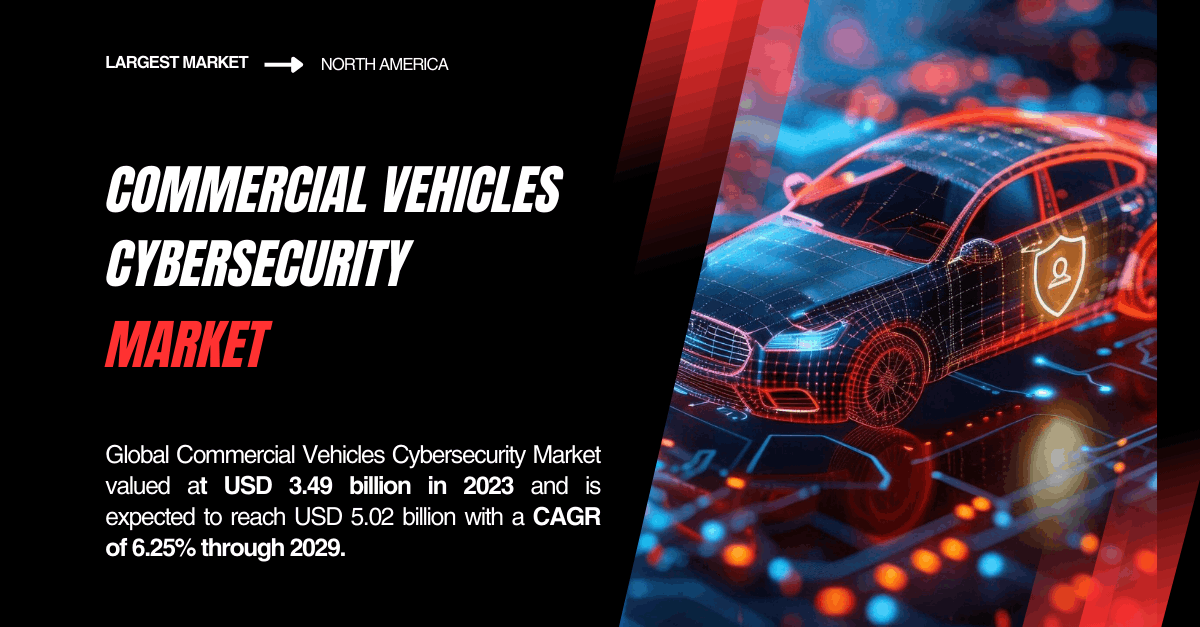

The global commercial vehicles cybersecurity market is witnessing significant growth, driven by advancements in connected technologies and increasing cybersecurity threats. According to TechSci Research, the market, valued at USD 3.49 billion in 2023, is projected to reach USD 5.02 billion by 2029, growing at a CAGR of 6.25%. This growth reflects the rising need for robust cybersecurity solutions to protect against vulnerabilities associated with the digitalization of commercial vehicles.

This report delves into the factors influencing the market, key trends, challenges, and opportunities, along with insights into major market players and future outlooks.

Commercial Vehicles Cybersecurity Market Dynamics

Drivers of Growth

- Connected Vehicle Technologies

The proliferation of connected vehicle technologies, such as telematics, IoT devices, and vehicle-to-everything (V2X) communications, is transforming the commercial vehicle landscape. These advancements improve operational efficiency but expose vehicles to cyber risks, necessitating advanced cybersecurity measures.

- Stringent Regulatory Mandates

Governments worldwide are enforcing stringent regulations to ensure the cybersecurity of commercial vehicles. Compliance with standards such as ISO/SAE 21434:2021 has become critical for manufacturers and fleet operators to protect vehicle systems and data.

Browse over XX market data Figures spread through XX Pages and an in-depth TOC on “Commercial Vehicles Cybersecurity Market.” @ https://www.techsciresearch.com/report/commercial-vehicles-cybersecurity-market/19324.html

- Rising Cybersecurity Threats

The frequency and sophistication of cyber-attacks targeting automotive systems have escalated. Commercial vehicles, with their complex interconnected systems, are increasingly vulnerable to unauthorized access, data breaches, and operational disruptions.

Commercial Vehicles Cybersecurity Market Challenges

- Complexity of Securing Diverse Vehicle Systems

Commercial vehicles comprise a variety of systems, including telematics, infotainment, and electronic control units (ECUs). The complexity of securing these interconnected components poses a significant challenge for cybersecurity providers.

- High Costs of Implementation

Implementing comprehensive cybersecurity measures involves substantial costs, making it challenging for smaller fleet operators to adopt such solutions. Cost-effectiveness remains a key barrier to market growth.

Commercial Vehicles Cybersecurity Market Segmentation

By Security Type

Application Security

Application security focuses on protecting software applications and systems within commercial vehicles. This includes securing telematics, driver assistance features, and infotainment systems against unauthorized access and cyber threats.

Network Security

Network security ensures the integrity of communication channels and data flows within vehicle networks. Technologies such as firewalls, intrusion detection systems (IDS), and encryption protocols are employed to safeguard vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communications.

Endpoint Security

Endpoint security protects individual devices, such as ECUs and onboard computers, within commercial vehicles. Measures include deploying antivirus software, endpoint detection, and response systems (EDR) to prevent unauthorized access to vehicle components.

Technological Advancements in Commercial Vehicles Cybersecurity Market

- Artificial Intelligence and Machine Learning

AI and ML are revolutionizing cybersecurity by enabling real-time threat detection and proactive response mechanisms. These technologies analyze vast datasets to identify anomalous behavior and potential security incidents, enhancing the overall cybersecurity posture.

- Blockchain for Data Security

Blockchain technology is emerging as a robust solution for secure data management in commercial vehicles. By ensuring data immutability and transparency, blockchain enhances trust in connected vehicle systems.

- Cloud-Based Cybersecurity Solutions

Cloud-based solutions offer scalable and flexible security for large commercial fleets. They enable remote monitoring and management of cybersecurity measures, ensuring robust protection across geographically dispersed operations.

Key Trends of Commercial Vehicles Cybersecurity Market

Shift Toward Electric and Autonomous Vehicles

The growth of electric and autonomous vehicles is creating new opportunities and challenges in the cybersecurity domain. These vehicles, with their unique technological requirements, demand specialized security solutions to mitigate emerging threats.

Increased R&D Investments

Investments in research and development are driving innovation in cybersecurity technologies. From advanced encryption methods to intrusion prevention systems, companies are continuously enhancing their offerings to meet evolving market demands.

Focus on Customized Cybersecurity Solutions

Tailored cybersecurity solutions that address the specific needs of different vehicle segments, such as long-haul trucks, buses, and delivery fleets, are gaining traction in the market.

Major Developments in the Commercial Vehicles Cybersecurity Industry

- ISO/SAE 21434:2021 Certification

Continental Automotive, a leading player in the market, achieved ISO/SAE 21434:2021 certification in June 2023. This standard provides a comprehensive framework for managing cybersecurity risks throughout the lifecycle of automotive systems, demonstrating the company’s commitment to robust cybersecurity management.

- Partnerships and Collaborations

Key industry players are forming strategic alliances to enhance their cybersecurity capabilities. Collaborations between automotive manufacturers, cybersecurity firms, and technology providers are accelerating the development of innovative solutions.

Commercial Vehicles Cybersecurity Market Competitive Landscape

Major Players in the Commercial Vehicles Cybersecurity Market

- Intel Corporation

Intel leverages its expertise in computing and security technologies to provide robust solutions for commercial vehicles.

- ETAS GmbH

ETAS specializes in cybersecurity solutions tailored to the automotive sector, focusing on secure software development and system integration.

- Karamba Security Ltd.

Karamba Security offers endpoint protection solutions designed to prevent cyber-attacks on connected vehicle systems.

- Denso Corporation

Denso focuses on integrating cybersecurity into automotive hardware and software, ensuring end-to-end protection for commercial vehicles.

- Continental AG

Continental is a leader in developing comprehensive cybersecurity frameworks, including its ISO-certified Cybersecurity Management System (CSMS).

Other notable companies include NNG Software, Harman International Industries, Robert Bosch GmbH, Cisco Systems Inc., and ZF Friedrichshafen AG.

Opportunities in the Commercial Vehicles Cybersecurity Market

Expansion of Electric and Autonomous Vehicles

The rising adoption of electric and autonomous vehicles presents a lucrative opportunity for cybersecurity providers. Developing tailored solutions for these segments can address unique challenges and ensure safe operations.

Specialized Cybersecurity Services

There is a growing demand for specialized cybersecurity services, such as penetration testing and threat intelligence, aimed at enhancing the resilience of commercial vehicle systems.

Emergence of 5G Connectivity

The deployment of 5G technology is expected to boost the efficiency of connected vehicle systems while also necessitating advanced cybersecurity measures to secure high-speed data exchanges.

Download Free Sample Report @ https://www.techsciresearch.com/sample-report.aspx?cid=19324

Customers can also request 10% free customization on this report.

Commercial Vehicles Cybersecurity Market Future Outlook

As the digitalization of commercial vehicles continues to advance, the cybersecurity market is poised for substantial growth. Effective strategies encompassing application, network, and endpoint security will be critical to safeguarding vehicle operations against evolving threats.

Companies must focus on integrating cutting-edge technologies, complying with regulatory standards, and addressing cost challenges to tap into the market’s potential. The future of commercial vehicle cybersecurity lies in innovative, scalable, and customizable solutions that ensure operational safety and data integrity.

Conclusion

The global commercial vehicles cybersecurity market is evolving rapidly, driven by technological advancements and heightened cybersecurity concerns.

As connected and autonomous vehicle technologies become mainstream, the importance of robust cybersecurity cannot be overstated.

With continued investments in R&D, strategic collaborations, and regulatory compliance, the market is set to grow significantly through 2029, ensuring the security and resilience of commercial vehicle operations in an increasingly interconnected world.

You may also read:

Light Commercial Vehicle Telematics Market Size and Forecast: USD 34.8 Billion by {2029} with 7.31% CAGR

Automotive Seat Belts Market Growth: Analysis, Size, and Trends Leading to USD 14.37 Billion by {2029}

Automotive Adhesives & Sealants Market Size to Reach USD 10.84 Billion by {2029} with a CAGR of 5.53%

More Posts

Report This Post

Please complete the following requested information to flag this post and report abuse, or offensive content. Your report will be reviewed within 24 hours. We will take appropriate action as described in Findit terms of use.