Right Now

Electric Vehicle Components Market: [Comprehensive Report, 12.5% CAGR, USD 305 Billion Market Data]

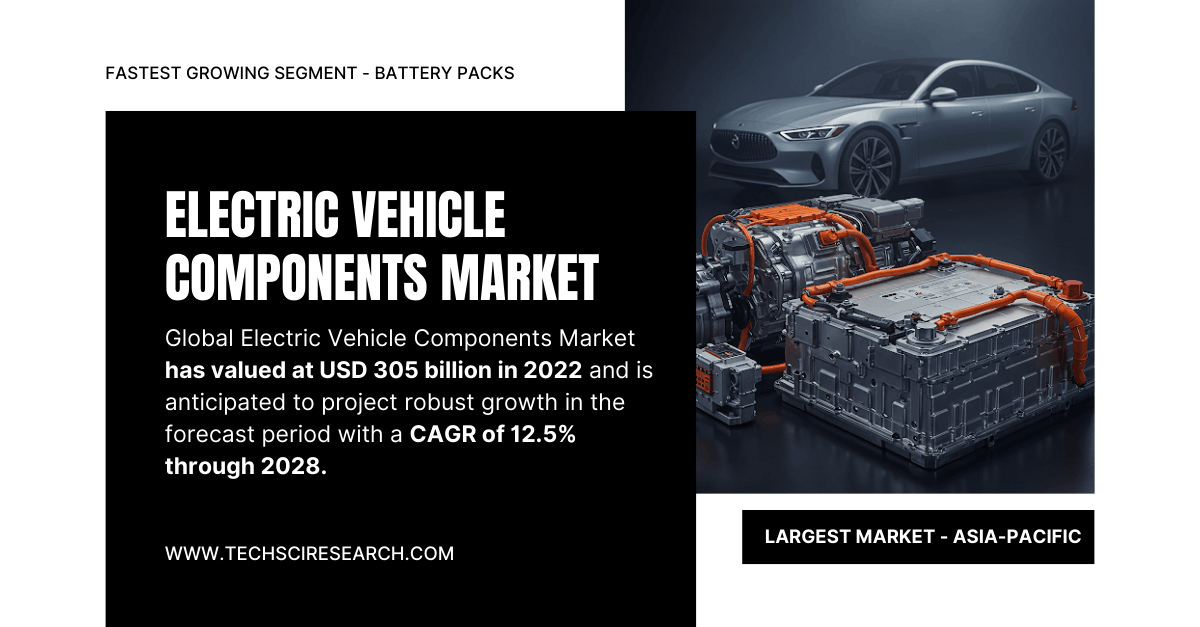

According to TechSci Research’s report, “Global Electric Vehicle Components Market – Global Industry Size, Share, Trends, Competition Forecast & Opportunities, 2028”, the market stood at USD 305 billion in 2022 and is anticipated to grow at a CAGR of 12.5% between 2024 and 2028. This growth is driven by factors including tightening emission norms, technological advancements, increasing environmental consciousness, and the expansion of EV infrastructure. The market’s development marks a significant shift toward sustainable mobility and a cleaner transportation ecosystem.

Electric Vehicle Components Market Overview

Electric vehicles (EVs) are reshaping the global automotive landscape. No longer viewed as niche alternatives, EVs are rapidly becoming mainstream due to their environmental advantages and technological sophistication. Governments, industries, and consumers alike are increasingly embracing electrification as a strategy to reduce carbon emissions and dependency on fossil fuels.

The global EV components market’s valuation of USD 305 billion in 2022 reflects the sector's rapid adoption. Driven by strong demand fundamentals and favorable regulatory policies, the market is projected to witness substantial growth in the near term. The period from 2024 to 2028 is expected to be particularly transformative.

Browse over XX market data Figures spread through XX Pages and an in-depth TOC on "Electric Vehicle Components Market.” @ https://www.techsciresearch.com/report/-electric-vehicle-components-market/4462.html

Key Growth Drivers of the Electric Vehicle Components Market

- Stringent Emission Norms and Regulatory Push

Governments worldwide are tightening emission norms to combat climate change and air pollution. These regulations are pushing automakers to accelerate the development and adoption of EVs, thereby boosting the demand for EV components.

- Advancements in Battery Technology

Battery technology continues to be at the heart of the EV revolution. Improvements in lithium-ion battery efficiency, energy density, and charging speed are addressing major consumer concerns like range anxiety. This enhances user confidence and supports wider EV adoption.

- Rising Environmental Awareness

Environmental concerns are reshaping consumer preferences. Increasing awareness about climate change, pollution, and sustainable practices is encouraging individuals to switch from traditional internal combustion engine (ICE) vehicles to EVs.

- Falling Costs of EVs

The decreasing cost of EV manufacturing, particularly battery costs, is making EVs more accessible to a broader demographic. This trend is expected to continue, further accelerating market expansion.

- Growth in Charging Infrastructure

The development of extensive EV charging infrastructure—both public and private—is essential to support increasing EV numbers. Government initiatives and private sector investments in Electric Vehicle Supply Equipment (EVSE) are fostering a robust support system for EV adoption.

Core Electric Vehicle Components

1. Battery Packs – The Heart of EVs

Battery packs, especially lithium-ion types, dominate the EV component landscape. Continuous R&D is leading to improved thermal stability, energy density, and cost efficiency.

Key Innovations:

Solid-state batteries (emerging)

Fast-charging capabilities

Extended lifecycle

2. Electric Motors – Driving the Revolution

Electric motors convert electrical energy into mechanical power. Both AC and DC motors are used in EVs depending on the performance needs.

Recent Trends:

Integration of permanent magnet motors

Use of lighter and more efficient materials

Reduction in power loss

3. Power Electronics

This category includes:

DC-DC Converters

Inverters

Controllers

These devices regulate power flow between the battery and the motor, playing a crucial role in efficiency and vehicle performance.

4. On-Board Chargers (OBCs)

OBCs facilitate charging through AC power from external sources. Modern OBCs are becoming smaller, lighter, and more efficient to meet the dynamic needs of next-gen EVs.

5. Thermal Management Systems

As EVs involve high electrical loads and heat generation, thermal systems are essential to maintain component safety and performance. These systems also influence battery longevity and efficiency.

6. EV Management Systems

Sophisticated on-board computers manage:

Battery usage

Energy regeneration

System diagnostics

Safety alerts

Their role is vital in integrating all components for optimal operation and enhanced user experience.

7. Electric Drivetrain and Regenerative Braking

The drivetrain integrates the motor, inverter, and transmission system. Regenerative braking systems improve energy efficiency by converting kinetic energy back into stored energy.

Electric Vehicle Supply Equipment (EVSE)

Building the Backbone of EV Adoption

The EVSE network includes:

Public and private charging stations

Fast chargers

Smart charging systems

These components are crucial to mass EV adoption by mitigating range anxiety and ensuring seamless operation.

Government & Private Initiatives

Governments worldwide are launching subsidies and incentive programs to accelerate the deployment of EVSE, while private players are investing in high-speed charging networks to support long-distance travel and urban usage.

Electric Vehicle Components Market Segmentation

By Vehicle Type

Passenger Vehicles

Commercial Vehicles

Passenger vehicles hold a dominant share, but commercial EVs (buses, delivery vans, trucks) are gaining traction due to increasing fleet electrification.

By Propulsion Type

Battery Electric Vehicle (BEV)

Plug-in Hybrid Electric Vehicle (PHEV)

Fuel Cell Electric Vehicle (FCEV)

Hybrid Electric Vehicle (HEV)

BEVs lead the segment, owing to their zero-emission advantage and growing infrastructure. FCEVs, though in nascent stages, show potential in heavy-duty applications.

By Component Type

Battery Packs

DC-DC Converter

Controller & Inverter

Motor

On-Board Chargers

Other Component Types (thermal systems, management systems, etc.)

Regional Analysis of Electric Vehicle Components Market

North America

Strong regulatory support for EV adoption

Expansion of charging infrastructure

Significant investments from Tesla, GM, and Ford

Europe

Aggressive emission targets under EU Green Deal

Prominent players in EV battery technology

High adoption rate of electric passenger vehicles

Asia-Pacific

Leading global EV production hub

China dominates in battery manufacturing and EVSE deployment

Indian market shows emerging potential with strong government backing

Emerging Trends

Offering greater energy density, safety, and faster charging, these batteries are poised to revolutionize the EV market in the next decade. Advanced driver-assistance systems (ADAS) and predictive maintenance via IoT will increase dependency on sophisticated EV components.

To counter battery weight, the use of lightweight materials such as aluminum, carbon fiber, and magnesium is increasing in component design. Still in early phases, wireless charging is expected to offer seamless convenience and could influence future EV infrastructure layouts.

Competitive Landscape

Key Industry Players

Continental AG

Robert Bosch GmbH

Denso Corporation

Hella GmbH & Co. KGaA

Toyota Industries Corporation

Hyundai Mobis

Samsung SDI Co Ltd

Panasonic Corporation

Contemporary Amperex Technology Co. Ltd (CATL)

BorgWarner Inc.

Recent Developments

Denso Corporation: Developed components supplied to Toyota bZ4x and Subaru Solterra.

Panasonic Corporation: Acquired a U.S. facility to expand lithium-ion battery production for Tesla.

These developments highlight strategic moves by companies to stay competitive and support growing EV demand.

Download Free Sample Report @ https://www.techsciresearch.com/sample-report.aspx?cid=4462

Customers can also request 10% free customization on this report.

Challenges

Despite falling battery prices, the initial cost of EVs and their components still poses a barrier in developing markets.The management of used lithium-ion batteries poses environmental and regulatory challenges.In rural and underdeveloped areas, inadequate EVSE coverage may hinder EV growth. The availability and ethical sourcing of critical minerals like lithium, cobalt, and nickel are ongoing concerns.

Opportunities and Growth Potential

1. Government Incentives

Tax benefits, subsidies, and incentives for both manufacturers and consumers will continue driving growth.

2. Fleet Electrification

Corporate and public fleets are being increasingly electrified, opening vast opportunities for EV component suppliers.

3. Technological Partnerships

Collaborations between automakers and tech firms are fostering innovation in component efficiency and integration.

4. Second-life Battery Applications

Repurposing EV batteries for energy storage solutions presents an emerging revenue stream.

Conclusion

The global electric vehicle components market is undergoing rapid transformation driven by environmental regulations, technological innovation, and evolving consumer preferences. As EVs become more mainstream, component manufacturers will play a pivotal role in shaping the automotive future. Continued investments in R&D, infrastructure, and partnerships will be crucial in addressing the existing challenges and capitalizing on emerging opportunities. With a CAGR of 12.5% projected for the 2024–2028 period, the market promises robust growth, marking a new era of sustainable mobility.

You may also read:

Electric Vehicle Connector Market Demands: [USD 85 Million, Latest Market Report]

Electric Vehicle Range Extender Market Size: USD 3.2 Billion Forecast & Key Player Analysis

Automotive Rubber Molded Components Market: Latest Report, {5.5%+ CAGR} and USD 59 Billion Forecast

Automotive Simulation Market Size: Forecast, Key Player Shares & Trends

Automotive Blockchain Market Size: USD 0.4 Billion to USD 3.8 Billion - Latest Report

More Posts

Report This Post

Please complete the following requested information to flag this post and report abuse, or offensive content. Your report will be reviewed within 24 hours. We will take appropriate action as described in Findit terms of use.