Right Now

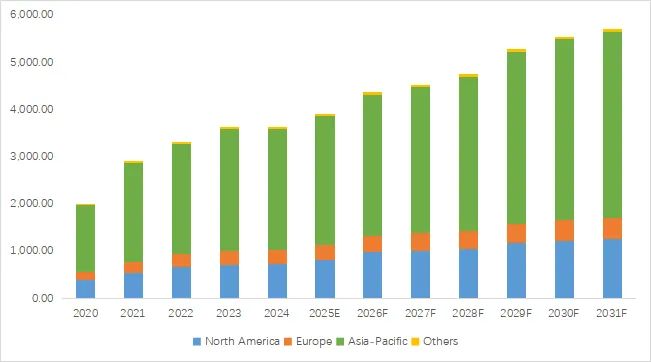

Camera SOC Market Research:the camera SOC has the highest market share in Asia Pacific, accounting for 69.70% of all sales.

SoC (System on Chip) is a highly integrated microchip. SoC usually has a built-in central processing unit (CPU) and a graphics processing unit (GPU) and adds processing cores such as image signal processor (ISP), neural network processor (NPU), multimedia video codec and audio processor according to the needs of the usage scenario. There is a high-speed bus inside the chip that is responsible for data transmission between each processing unit and the external interface. It is also equipped with flash memory interface, storage interface, display interface, network interface and various high-speed and low-speed data transmission interfaces. SoC can process digital signals, analog signals, mixed signals, and even radio frequency signals, and is often used in embedded systems.

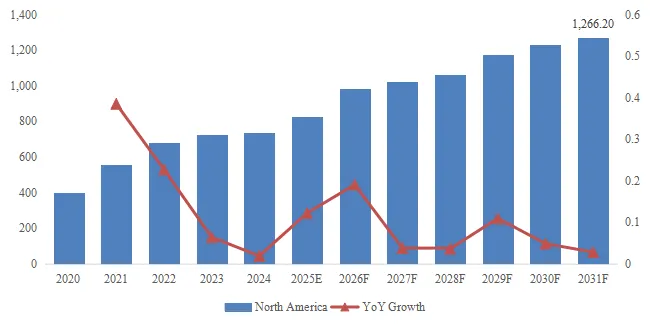

North America market for Camera SOC was valued at $ 736.57 million in 2024 and will reach $ 1266.20 million by 2031, at a CAGR of 7.37% during the forecast period of 2025 through 2031.

Asia-Pacific market for Camera SOC was valued at $ 2558.73 million in 2024 and will reach $ 3953.39 million by 2031, at a CAGR of 6.39% during the forecast period of 2025 through 2031.

Europe market for Camera SOC was valued at $ 293.47 million in 2024 and will reach $ 440.58 million by 2031, at a CAGR of 5.94% during the forecast period of 2025 through 2031.

Figure00001. Camera SOC, Global Market Size, Split by Region, 2020-2031

Source: QYResearch, "Camera SOC- Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031”

According to the figure, camera SOC has the highest market share in Asia Pacific, accounting for 69.70% of all sales.

Figure00002. Camera SOC North American Market Share (Ranking is based on the revenue of 2025, continually updated)

Source: QYResearch, "Camera SOC- Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031”

North America:

North America is driven by technological innovation and high-end applications, especially in the fields of autonomous driving and AR/VR. For example, Mobileye's EyeQ series chips optimize vision processing capabilities through AI algorithms to support real-time decision-making for L4 autonomous driving, while NVIDIA and Qualcomm rely on heterogeneous computing architectures to drive high-performance SoCs in edge computing and smart devices. However, the region faces U.S. export control restrictions on advanced process equipment and technology, leading to supply chain fragmentation risks, while dealing with rising compliance costs from data privacy regulations such as GDPR. In addition, technical barriers in the high-end market require local companies to continue to invest in AI algorithms and multimodal processing technologies to maintain competitiveness.

Europe:

The driving factors in Europe are mainly due to strict regulations and green manufacturing orientation of the automobile industry. Regulations such as ECER129 mandated by the European Union are driving companies such as NXP to develop low-power automotive grade SoCs. At the same time, the depth of Industry 4.0 has prompted the integration of SoC and IoT ecosystems. However, Europe faces the vulnerability of its supply chain relying on Asian foundries. The conflict between Russia and Ukraine exacerbates the risk of raw material shortages. Moreover, technology iteration lags behind that of China and the United States, and high-end market share is squeezed. In addition, environmental regulations require SoCs to integrate security modules (HSMs) and low power designs, further driving up R & D costs.

Asia-Pacific:

Asia-Pacific is an engine of growth with policy support and consumer electronics demand. China promotes enterprises to break through ISP and AI integration technology through "National Major Project of Integrated Circuit Industry". Japan and South Korea rely on the advantages of high-end sensors and manufacturing processes to dominate the smartphone and professional camera SoC market. Southeast Asia and India have adopted policies such as "Make in India" to attract companies such as Foxconn to set up factories to reduce the cost of low-and mid-end SoC manufacturing. However, the region faces core technology dependency, price wars compressing margins, and yield volatility due to immature supply chains in emerging markets (India, Southeast Asia). In addition, Sino-US technological friction exacerbates the risk of supply chain fragmentation, forcing companies to explore regional production collaboration.

About The Authors

Meng Yu Lead Author

Email: Yumeng@qyresearch.com

QYResearch Nanning Research Center analyst, main research areas include semiconductors, chemical materials, electronics and other fields, some of the sub-research topics include Motor for semiconductor equipment, air bearing stage, low CTE ceramic material, high purity oleic acid, camera soc, intelligent energy management system, etc., also engaged in market segment report development, and participate in the writing of customized projects.

About QYResearch

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 17 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting (data is widely cited in prospectuses, annual reports and presentations), industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.

Contact Us:

If you have any queries regarding this report or if you would like further information, please contact us:

QY Research Inc.

Add: 17890 Castleton Street Suite 369 City of Industry CA 91748 United States

E-mail: global@qyresearch.com

Tel: 001-626-842-1666(US) 0086-133 1872 9947(CN)

More Posts

Report This Post

Please complete the following requested information to flag this post and report abuse, or offensive content. Your report will be reviewed within 24 hours. We will take appropriate action as described in Findit terms of use.