Right Now

Introduction to Industrial Radiation Sources

1. Introduction to Industrial Radiation Sources

An industrial radiation source, a radioactive isotope emitting ionizing radiation, is of great significance in diverse industrial applications. It serves crucial functions in material testing, product sterilization, and quality control. Depending on the specific isotope, these sources can emit gamma rays, beta particles, or neutrons. To guarantee safety during use, they are typically sealed within secure containers. In non-contact and high-precision processes where conventional methods fall short or are overly invasive, industrial radiation sources play an irreplaceable role. According to QYR, The global Industrial Radioactive Isotope market size is projected to reach US$ 539.59 million by 2030, from US$ 400 million in 2024, at a CAGR of 5.14% during 2024-2030.

2. Market Landscape

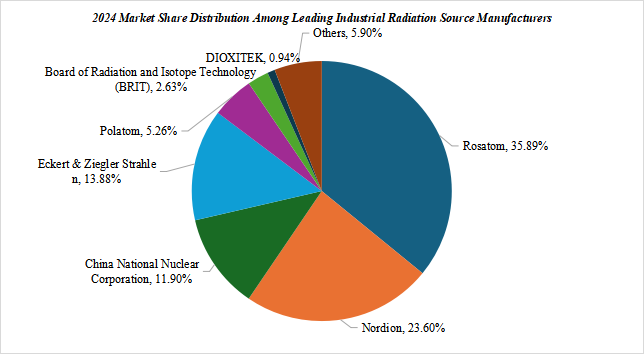

The industrial radiation source market is shaped by a select group of leading manufacturers. Rosatom, Nordion, China National Nuclear Corporation (CNNC), Eckert & Ziegler Strahlen, Polatom, the Board of Radiation and Isotope Technology (BRIT), and DIOXITEK are among the key players. These companies hold sway over the global supply chain, with each specializing in the production and distribution of various radioisotopes essential for industrial applications. Their combined efforts determine the availability and quality of industrial radiation sources in the global market.

Figure 2. The Top 7 Players Market Share by Industrial Radioactive Isotope Revenue in 2024

Source: QYResearch, 2024

3. Primary Categories of Industrial Radiation Sources

The main types of industrial radiation sources include Cobalt - 60, Iridium - 192, Cesium - 137, Selenium - 75, Americium - 241, Krypton - 85, and Californium - 252, among others. Cobalt - 60 and Iridium - 192 are the most extensively used, especially in applications demanding high-energy gamma radiation. Each isotope has its own unique set of specific use cases, which are determined by factors such as its physical properties, half-life, and radiation type. In 2024, Among them, cobalt 60 accounts for more than 50% of the market share, followed by iridium 192, cesium 137, selenium 75, americium 241, krypton 85, and californium 252.

Properties and Applications of Main Industrial Radiation Source Isotopes

Isotope | Main Industrial Applications |

Cobalt-60 | - Sterilization of medical devices |

Iridium-192 | - Industrial radiography |

Cesium-137 | - Level gauging |

Selenium-75 | - Gamma radiography (ideal for thin metal parts) |

Americium-241 | - Moisture and density gauges |

Krypton-85 | - Thickness and level measurement |

Californium-252 | - Neutron radiography |

Source: QYResearch, 2024

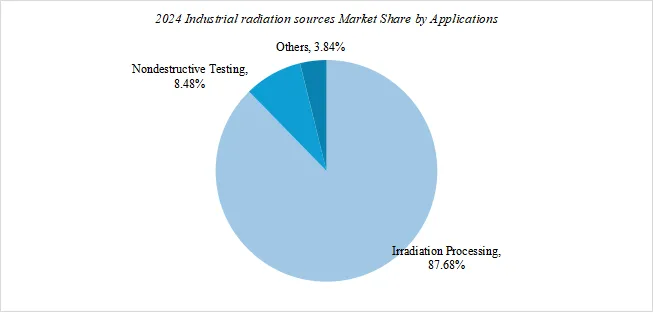

4. Application Areas

Industrial radiation sources are mainly applied in irradiation processing and nondestructive testing (NDT), and also find niche applications in different industrial sectors. Irradiation processing is involved in sterilizing medical products, preserving food, and modifying materials. Nondestructive testing uses radiation to examine the integrity of materials and structures without causing any damage, which is vital in industries like aerospace, construction, and oil and gas.

Figure 3. 2024 Market Share by Applications

Source: QYResearch, 2024

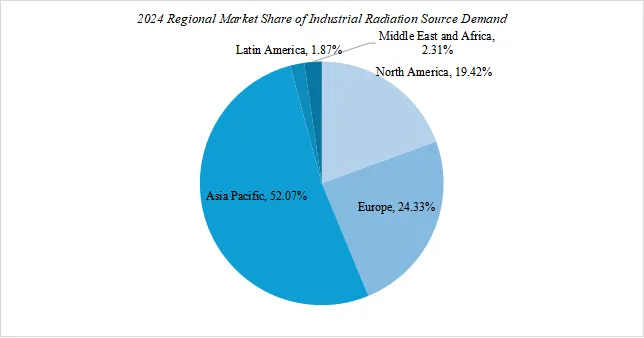

5. Regional Demand

In terms of regional demand, the Asia-Pacific region is the dominant consumer globally, accounting for over 50% of the market share. The rapid industrialization and increasing investment in healthcare, infrastructure, and manufacturing sectors in this region drive this high demand. China, in particular, represents the largest national market within the Asia-Pacific. Europe follows with approximately 25% of global demand, and North America accounts for around 20%, reflecting its mature industrial base and continuous need for high-precision testing and processing technologies.

Figure 4. 2024 Regional Market Share of Industrial Radiation Source Demand

Source: QYResearch, 2024

6. Impact of Geopolitical Developments

Geopolitical developments, especially trade policies, have had a substantial impact on the industry. For example, the tariff measures implemented during the Trump administration significantly influenced global supply chains and regulatory dynamics. Rosatom, the Russian state atomic energy corporation, has been particularly affected, facing increased scrutiny and trade barriers in key export markets. These policies have not only influenced pricing and availability but have also spurred end-users and regulators worldwide to diversify supply sources and adopt localization strategies.

Impact of Trump’s tariff policy like Rosatom

Isotope | Main Industrial Applications | Impact of Trump’s Tariff Policy |

Cobalt-60 | - Sterilization of medical devices | Trade restrictions and tariffs have increased import costs and complicated cross-border logistics, particularly for Rosatom-produced Cobalt-60. |

Iridium-192 | - Industrial radiography | Rosatom and other non-U.S. suppliers faced additional regulatory scrutiny and tariff-related delays. |

Cesium-137 | - Level gauging | Tariffs have increased sourcing costs, encouraging U.S. industries to seek domestic or non-sanctioned alternatives. |

Selenium-75 | - Gamma radiography (ideal for thin metal parts) | Supply chain disruptions from non-U.S. producers affected availability and lead times. |

Americium-241 | - Moisture and density gauges | Limited direct impact, but broader nuclear import controls have introduced compliance and logistics hurdles. |

Krypton-85 | - Thickness and level measurement | Indirect effects via tightened control on isotope transport and stricter licensing policies. |

Californium-252 | - Neutron radiography | High strategic value made it subject to tight import/export controls; tariffs exacerbated sourcing challenges. |

Source: QYResearch, 2024

Contact Us:

If you have any queries regarding this report or if you would like further information, please contact us:

QY Research Inc.

Add: 17890 Castleton Street Suite 369 City of Industry CA 91748 United States

EN: https://www.qyresearch.com

Email: global@qyresearch.com

Tel: 001-626-842-1666(US)

JP: https://www.qyresearch.co.jp

More Posts

Report This Post

Please complete the following requested information to flag this post and report abuse, or offensive content. Your report will be reviewed within 24 hours. We will take appropriate action as described in Findit terms of use.