Right Now

Power Inductors Research Report: the global Power Inductors market size is projected to reach USD 5.58 billion by 2031

SMD Power Inductors, also known as surface-mount Power Inductors, are passive electronic components designed for use in surface mount manufacturing processes. They typically consist of a magnetic core and copper windings. These inductors are characterized by their compact size, high quality, excellent energy storage capabilities, and low resistance. They are commonly used in circuits that require filtering, energy storage, and vibration suppression.

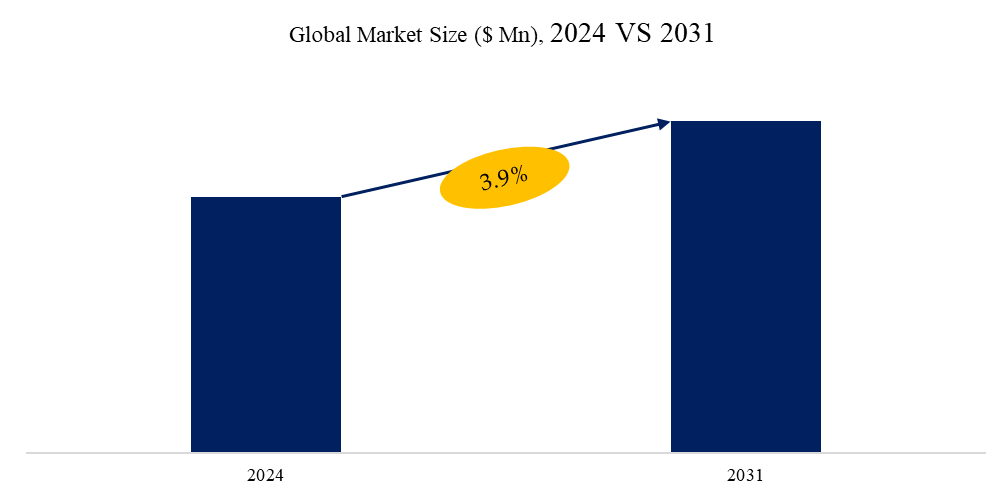

According to the new market research report “Power Inductors - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031”, published by QYResearch, the global Power Inductors market size is projected to reach USD 5.58 billion by 2031, at a CAGR of 3.9% during the forecast period.

The global SMD Power Inductors market is poised for steady growth, driven by technological advancement, increasing power density demands, and widespread adoption across emerging and traditional sectors. Manufacturers that can balance product innovation, quality assurance, and flexible supply strategies—while building robust channel partnerships—will be well-positioned to succeed. However, overcoming challenges such as miniaturization limits, pricing pressure, and customization complexity will require continuous investment in materials science, automation, and customer-centric design capabilities. As industries move toward higher efficiency and smarter systems, SMD Power Inductors will continue to play a fundamental role in the evolving electronic ecosystem.

Despite the growth outlook, the SMD Power Inductors industry has faced challenges in recent years due to price volatility. Influenced by shifts in raw material costs (such as ferrite powders, copper, and rare earths), global supply-demand imbalances, and advancements in manufacturing techniques, in some years, price fluctuations exceeded 9%, and inductor prices have experienced significant fluctuations—averaging a 1.54% increase. These price movements introduce uncertainty for both component suppliers and end users, complicating inventory planning and contract pricing. While some manufacturers have managed to pass these costs on to customers, others face margin pressures. The SMD Power Inductors market must navigate cost pressures, material shortages, thermal constraints, and disruptive technologies to sustain growth. Companies that invest in advanced materials (e.g., high-temperature alloys), automation (for precision manufacturing), and high-reliability designs will be best positioned to overcome these challenges.

Geopolitical and trade-related issues also contribute to market uncertainty. In particular, U.S. trade policies—such as tariffs, restrictions on key component exports, and tensions with China—have disrupted traditional global supply chains. Some OEMs and component suppliers are now re-evaluating sourcing strategies, seeking to diversify their manufacturing footprints beyond China or reduce exposure to politically sensitive regions. These shifts may result in longer lead times, increased operational costs, and the need for dual-sourcing strategies, especially for automotive and industrial customers with strict reliability requirements.

Technological innovation remains a driving force in the market. Manufacturers are investing in new materials and structural designs to produce SMD Power Inductors that are smaller, more thermally stable, and capable of operating at higher frequencies and currents. Trends such as vehicle electrification, 5G rollout, and the rise of AI and edge computing are creating demand for high-performance SMD Power Inductors used in power regulation, signal filtering, and electromagnetic compatibility. Notably, the growing adoption of metal composite SMD Power Inductors and TLVR (Transient Low Voltage Regulator) SMD Power Inductors in automotive and data center applications is reshaping the product landscape.

Going forward, regional market dynamics are expected to evolve. While Asia-Pacific remains the dominant production and consumption base due to its robust electronics manufacturing ecosystem, other regions—particularly North America and Europe—are increasing domestic investment in passive components amid concerns about supply chain resilience. Additionally, government incentives for semiconductor and electronics manufacturing are likely to spur localized growth, especially for strategic applications such as EVs, renewable energy, and aerospace electronics.

In summary, the global SMD Power Inductors market is on a path of steady expansion, backed by rising demand across emerging technologies and infrastructure systems. However, it remains sensitive to raw material pricing, geopolitical risks, and trade-related disruptions. Manufacturers who invest in R&D, supply chain flexibility, and advanced production capabilities will be best positioned to capitalize on the next wave of growth in this essential component sector.

Figure00001. Global SMD Power Inductors Market Size (US$ Million), 2024 vs 2031

Source: QYResearch, "Power Inductors - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031”

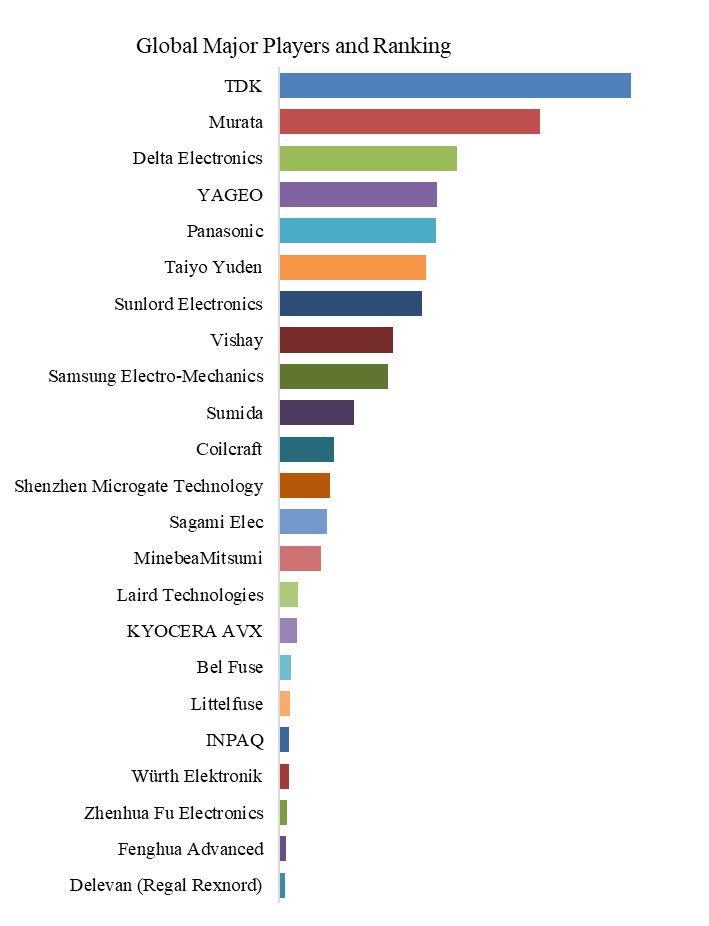

Figure00002. Global SMD Power Inductors Top 23 Players Ranking and Market Share (Ranking is based on the revenue of 2024, continually updated)

Source: QYResearch, "Power Inductors - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031”

According to QYResearch Top Players Research Center, the global key manufacturers of Power Inductors include TDK, Murata, Delta Electronics, YAGEO, Panasonic, Taiyo Yuden, Sunlord Electronics, Vishay, Samsung Electro-Mechanics, Sumida, etc. In 2024, the global top 10 players had a share approximately 81.23% in terms of revenue.

In terms of product type, currently Shielded Type is the largest segment, hold a share of 70.0%.

In terms of product application, currently Telecom/Datacom is the largest segment, hold a share of 30.0%.

About the Authors

About QYResearch

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 17 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting (data is widely cited in prospectuses, annual reports and presentations), industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.

Contact Us:

If you have any queries regarding this report or if you would like further information, please contact us:

QY Research Inc.

Add: 17890 Castleton Street Suite 369 City of Industry CA 91748 United States

E-mail: global@qyresearch.com

Tel: 001-626-842-1666(US) 0086-133 1872 9947(CN)

More Posts

Report This Post

Please complete the following requested information to flag this post and report abuse, or offensive content. Your report will be reviewed within 24 hours. We will take appropriate action as described in Findit terms of use.