Right Now

1,3

Propanediol: 1,3-Propanediol: Global Manufacturing Landscape and Main

Applications

The global production capacity for 1,3 dihydroxypropane reached over 600,000

metric tons per year as of 2020. Asia is currently the largest producing region,

led by China which has an annual capacity of around 400,000 metric tons.

The

Global

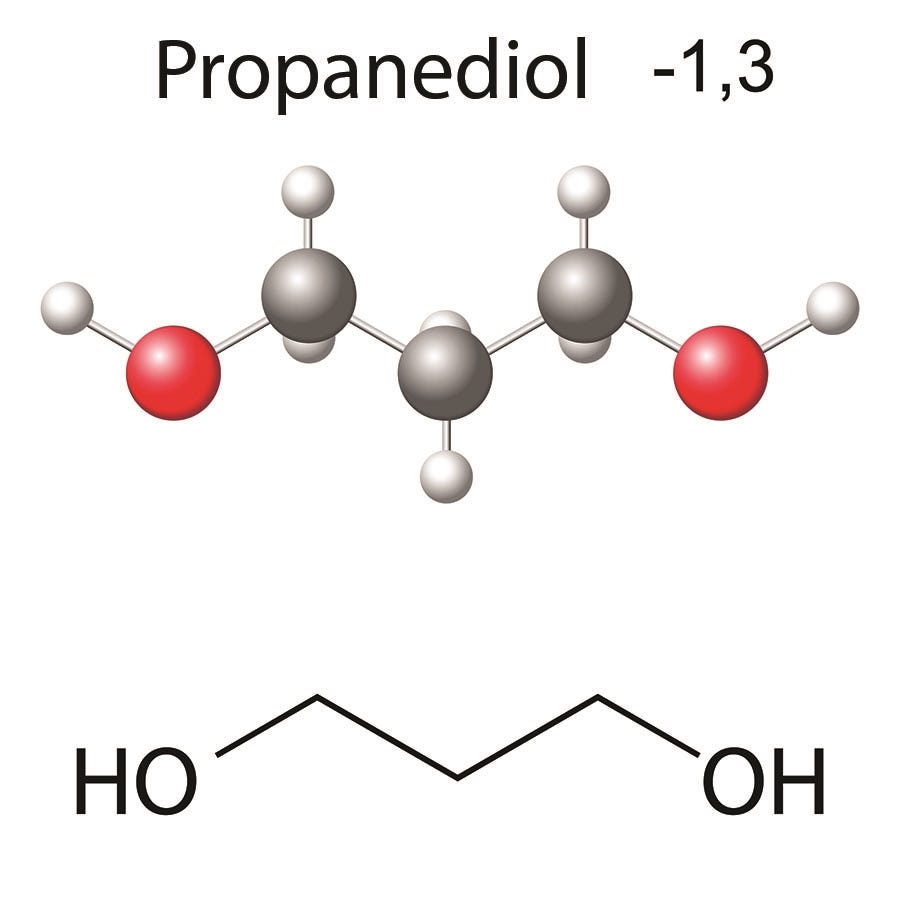

Production of 1,3 Propanediol, also known as trimethylene glycol or

PDO, is a colorless alcohol compound that has a variety of industrial uses. It

is mainly produced through the fermentation of plant-based sugars such as corn

sugar or sugarcane. 1,3 dihydroxypropane has three carbon atoms and two

hydroxyl functional groups, giving it the formula C3H8O2. This simple structure

allows it to be utilized in many applications.

Current Global Production Levels

The global production capacity for 1,3 dihydroxypropane reached over 600,000

metric tons per year as of 2020. Asia is currently the largest producing region,

led by China which has an annual capacity of around 400,000 metric tons. Within

China, many biodiesel and chemical companies have built sizable 1,3

dihydroxypropane fermentation facilities over the past decade. The largest

producers include Zhangjiagang Glory Biomaterial Co. Ltd, Godavari

Biorefineries Ltd, and Synbra Technology. North America and Europe also have

significant PDO manufacturing capabilities totaling over 100,000 metric tons

collectively. Major Western producers include DuPont Tate & Lyle Bio

Products, Genomatica, and Corbion. Production is expected to increase

substantially in the coming years to meet growing demand for PDO-based

materials and chemicals.

Applications in Polytrimethylene

Terephthalate

The biggest end use for 1,3 dihydroxypropane is in the production of

polytrimethylene terephthalate (PTT), a synthetic polyester textile fiber.

Around 50% of global PDO output is converted to PTT, which is a soft, durable,

elastic fiber with moisture-wicking properties. PTT can be blended with other

synthetic and natural fibers to produce a vast array of textiles for apparel,

household goods, and industrial materials. As an alternative to nylon, PTT

continues gaining share in carpets and rugs where its elasticity

provides increased resilience and durability through years of foot traffic.

Additional PTT applications include surgical sutures, fishing lines, and

automotive components that benefit from the material's stretch, strength, and

resistance to harsh chemicals and temperature extremes.

Use in Polyurethanes

Another major end use for 1,3 dihydroxypropane is in the manufacture of

polyurethane plastics and elastomers. Around 25% of global PDO production goes

toward various polyurethane applications. When reacted with diisocyanates, 1,3

dihydroxypropane forms extremely versatile polyether polyols that serve as

building blocks for polyurethane polymers. Soft and flexible polyurethane foams

made from PDO-based polyols are widely used in bedding, upholstery, car seats,

and packaging. Polyurethane elastomers utilizing PDO offer high elasticity and

rebound properties desired for products like shoes, gloves, and medical

devices. Rigid and injection molded polyurethanes employing trimethylene

glycol-derived polyols exhibit strength and resilience suitable for industrial

machine parts, electrical components, and sports equipment. Continuous advances

are expanding the scope and performance of these materials.

Other Industrial and Consumer Products

Beyond textiles and plastics, 1,3 dihydroxypropane finds use in an array of

other applications thanks to its physical and chemical properties. It is

employed as an environmentally-friendly deicing fluid at airports due to its

low freezing point and rapid deicing capability. PDO also serves as a non-toxic

coolant and heat transfer fluid in geothermal and solar heating systems. In

personal care products, 1,3 dihydroxypropane acts as a humectant for

moisturizing creams and conditioners and provides emollient properties in

cosmetics. Additional uses of PDO encompass solvents, lubricants, hydraulic and

brake fluids, printing inks, and plasticizers. As environmental regulations

accelerate the replacement of volatile petrochemicals, biobased 1,3

dihydroxypropane continues expanding into new segments.

Outlook and Recent Developments

All projections indicate the 1,3 dihydroxypropane will

experience considerable growth globally through 2030 and beyond. The is

forecast to rise at 6-8% annually driven by expanding PTT, polyurethane, and specialty

chemical applications. To help meet rising demand, manufacturers are working to

develop more advanced and economical production technologies. Genomatica has

commercialized a novel fermentation process claiming 30% reduction in PDO

manufacturing costs.

Synbra

is doubling its Chinese capacity with state-of-the-art facilities. Corbion is

expanding offerings with high-purity forms of PDO suitable for food contact and

healthcare uses. Meanwhile, startups such as BioAmber and Global BioChem are

developing alternative chemical routes utilizing renewable feedstocks. While

Asia will likely remain dominant, North America and Europe are expected to see

the fastest percentage growth in 1,3 dihydroxypropane capacity and end use s. Overall, the future remains bright for

this versatile building block chemical produced from non-petroleum resources.

Get more insights: Global

1, 3 Propanediol

For

More Insights Discover the Report In language that Resonates with you

About Author:

Vaagisha

brings over three years of expertise as a content editor in the market research

domain. Originally a creative writer, she discovered her passion for editing,

combining her flair for writing with a meticulous eye for detail. Her ability

to craft and refine compelling content makes her an invaluable asset in

delivering polished and engaging write-ups.

(LinkedIn: https://www.linkedin.com/in/vaagisha-singh-8080b91)

More Posts

Report This Post

Please complete the following requested information to flag this post and report abuse, or offensive content. Your report will be reviewed within 24 hours. We will take appropriate action as described in Findit terms of use.