Right Now

Inductors Market Trends:the market was valued at US$ 6.30 billion in 2024 and is anticipated to reach US$ 8.76 billion by 2031

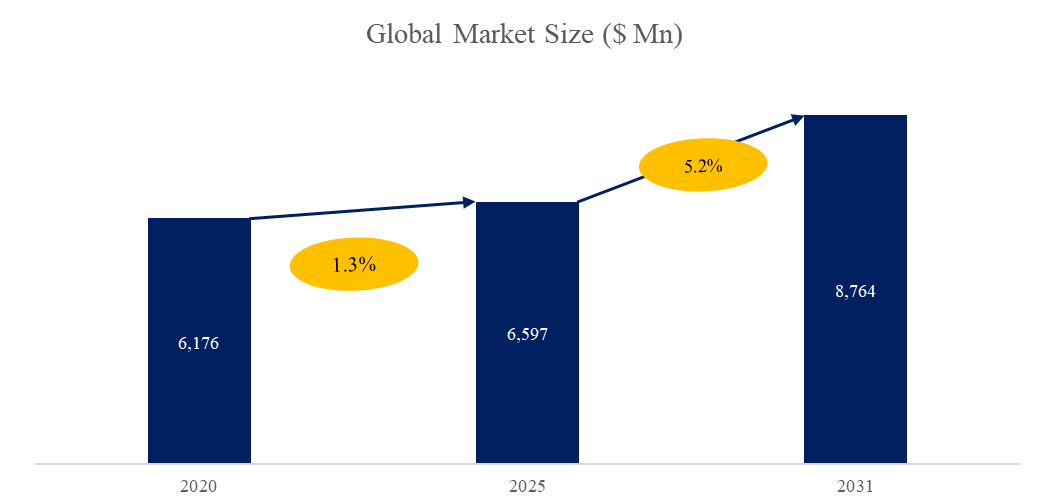

The global Inductors market was valued at US$ 6.30 billion in 2024 and is anticipated to reach US$ 8.76 billion by 2031, witnessing a CAGR of 4.85% during the forecast period 2025-2031. This growth is supported by increasing demand across a variety of application sectors, including consumer electronics, automotive systems, industrial power solutions, and communication infrastructure. As devices and systems become more compact, power-efficient, and functionally complex, inductors play a critical role in ensuring stable power delivery and signal integrity.

Figure. Global Inductors Market Size (US$ million), 2025-2031

Source: QYResearch, "Inductors - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031”

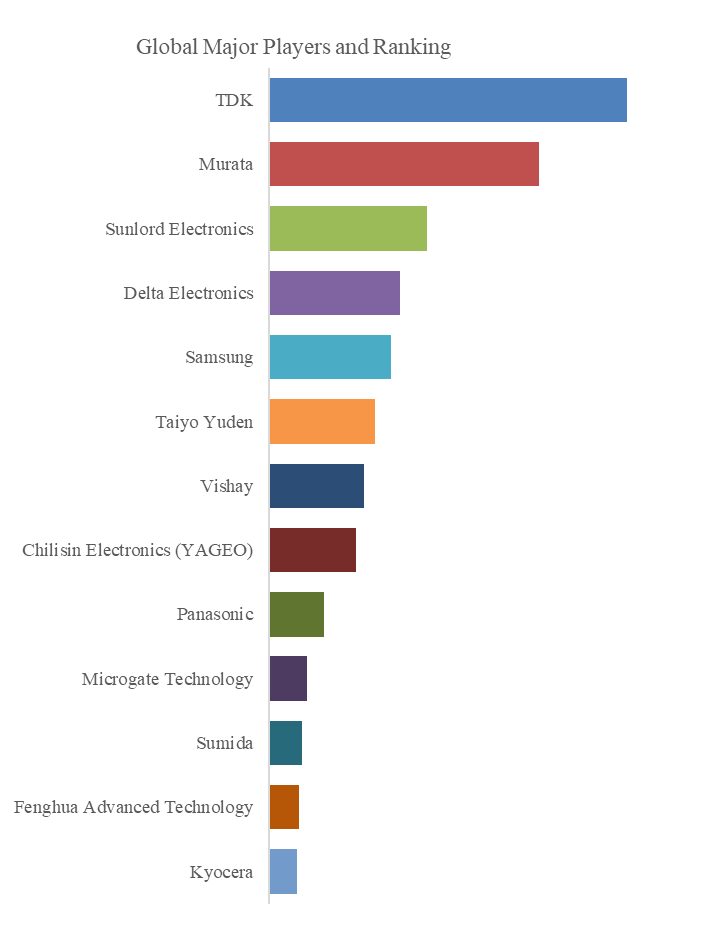

Figure. Global Inductors Top 13 Players Ranking and Market Share (Ranking is based on the revenue of 2024, continually updated)

Source: QYResearch, "Inductors - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031”

Inductors are often unseen but universally indispensable in modern electronics. As the world moves toward greater connectivity, electrification, and automation, the strategic importance of high-performance inductors continues to rise. With robust demand growth, technological innovation, and increasing policy support, the global inductor industry stands at the heart of the future electronics ecosystem.

1. Price Trends & Technical Cost Analysis

The global inductor continues to face significant pricing volatility. Historical data show that inductor prices have fluctuated notably, from USD 14.1 per 1,000 units in 2020 to a high of USD 17.2 in 2022, before stabilizing around USD 15.0 in 2024. This fluctuation—averaging a 1.54% annual price increase—has been driven by dynamic changes in raw material costs, such as ferrite powder, copper, and rare earths. Manufacturing advancements and scaling efficiencies have helped stabilize costs for some producers, but pricing remains a concern for procurement managers. As a result, forward-looking component buyers are increasingly entering long-term contracts and exploring alternative suppliers to manage risks and costs effectively.

2. Regional Market Landscape

The inductor market exhibits global demand, but regional dynamics are rapidly evolving. Asia-Pacific remains the largest production and consumption base, driven by the dominance of electronics manufacturing in China, Japan, South Korea, and Taiwan. North America and Europe remain critical for industrial, automotive, and high-end communications applications. Trade and geopolitical factors continue to reshape sourcing strategies. U.S. tariff policies and export controls, particularly in relation to China, have compelled OEMs to diversify supplier bases and invest in localized production. This realignment of the global value chain is contributing to longer lead times and higher costs in some regions, but also opening new opportunities for regional champions and emerging market players.

3. Technology Trends & Innovation

Inductors are evolving rapidly to meet the demands of increasingly miniaturized, high-frequency, and high-efficiency electronic systems. Key areas of innovation include automotive-grade inductors for electric vehicles (EVs), high-frequency chip inductors for 5G base stations, and ultra-thin SMD inductors for wearable and mobile devices. The push toward lower resistance, higher saturation current, and thermal stability is driving research into new core materials and multilayer fabrication techniques. Manufacturers are also innovating in packaging to enhance integration with ICs, supporting trends in power module design and compact form factors. The rise of AI accelerators and advanced driver assistance systems (ADAS) further underscores the demand for inductors with tight tolerances, low EMI, and excellent reliability in extreme environments.

4. Global & Chinese Key Players

The inductor market is moderately concentrated, with a few global leaders setting the tone for quality, innovation, and scale. TDK, Murata Manufacturing, and Sunlord Electronics collectively accounted for nearly 50% of global market revenue in 2024. TDK and Murata continue to lead in multilayer ceramic technology and high-frequency applications, while Sunlord has emerged as a competitive Chinese player with strong cost-efficiency and market reach. Other notable manufacturers include Taiyo Yuden, Vishay, Panasonic, Samsung Electro-Mechanics, Delta Electronics, Chilisin Electronics, and Microgate Technology. These players cover a broad spectrum of product categories and cater to various end markets. In China, companies are scaling aggressively to meet growing domestic demand, supported by favorable industrial policies and growing vertical integration in electronics manufacturing.

5. Application Areas

Inductors serve as essential passive components across virtually all electronic devices. In consumer electronics, they are integral to smartphones, tablets, PCs, and wearable devices. In automotive electronics, inductors are critical for powertrain control, battery management systems, and infotainment. The rise of EVs and plug-in hybrids is particularly influential, boosting demand for high-current, high-temperature inductors with long life cycles. In industrial automation and robotics, inductors enable power regulation and electromagnetic interference (EMI) suppression. Communication infrastructure—including 5G base stations, data centers, and satellite systems—relies heavily on high-frequency and surface-mount inductors. Medical devices, aerospace systems, and defense electronics further round out the landscape, demanding extremely reliable, compact, and customized inductor solutions.

6. Policy Support & Strategic Outlook

Global and national policies play a pivotal role in shaping the inductor industry. In China, "Made in China 2025" and the dual-circulation strategy support domestic production of key electronic components, including inductors. In the EU and North America, supply chain resilience and digital transformation strategies have catalyzed investment in regional electronics manufacturing. Environmental regulations are also influencing product design, pushing manufacturers to adopt lead-free soldering, RoHS compliance, and sustainable raw materials. The move toward electrification, digital infrastructure expansion, and strategic independence in semiconductor ecosystems bodes well for long-term inductor demand. To thrive in this environment, leading players are investing in R&D, expanding automation in manufacturing, and forming partnerships with OEMs to co-develop next-generation components.

About QYResearch

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 17 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting (data is widely cited in prospectuses, annual reports and presentations), industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.

Contact Us:

If you have any queries regarding this report or if you would like further information, please contact us:

QY Research Inc.

Add: 17890 Castleton Street Suite 369 City of Industry CA 91748 United States

E-mail: global@qyresearch.com

Tel: 001-626-842-1666(US) 0086-133 1872 9947(CN)

EN: https://www.qyresearch.com

JP: https://www.qyresearch.co.jp

More Posts

Report This Post

Please complete the following requested information to flag this post and report abuse, or offensive content. Your report will be reviewed within 24 hours. We will take appropriate action as described in Findit terms of use.