Right Now

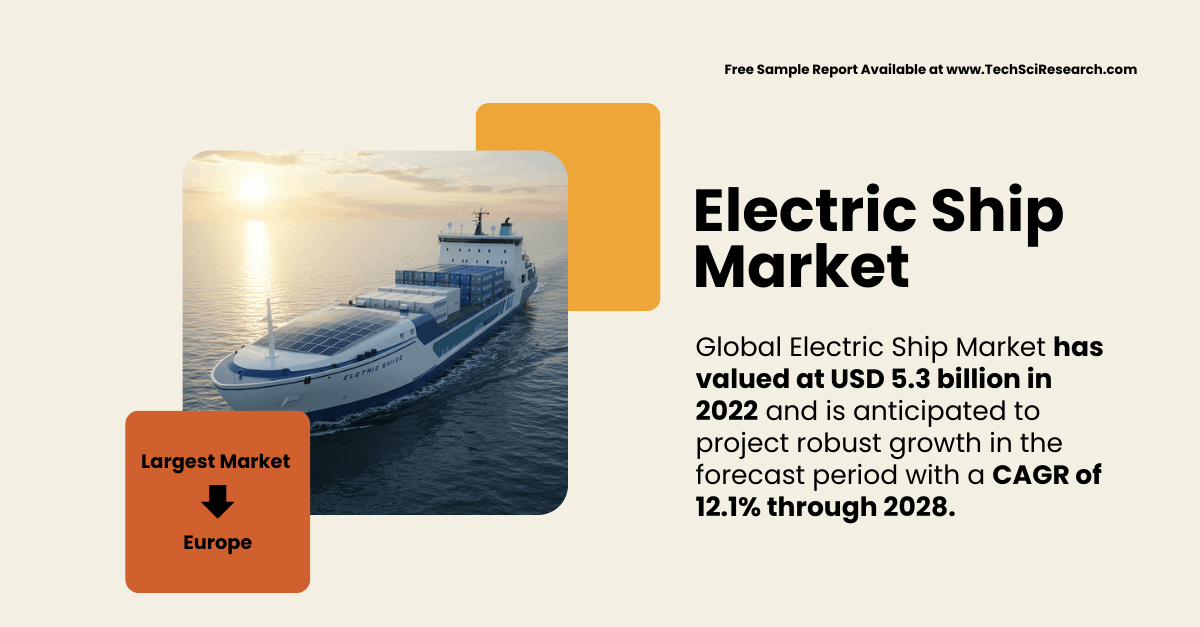

Electric Ship Market Size to Grow at [12.1% CAGR], Reaching USD 5.3 Billion

According to TechSci Research's latest report, “Electric Ship Market – Global Industry Size, Share, Trends, Competition Forecast & Opportunities, 2028,” the global electric ship market was valued at USD 5.3 billion in 2022 and is anticipated to expand at a robust CAGR of 12.1% during the forecast period from 2024 to 2028.

This growth is fueled by increasing environmental consciousness, tightening international emissions regulations, and rapid advancements in battery and propulsion technologies. The electric ship market is transforming the maritime industry by offering cleaner, more efficient, and sustainable alternatives to traditional fossil-fuel-based ships.

Introduction to Electric Ships

Definition and Functionality

Electric ships refer to marine vessels whose primary propulsion is driven by electric energy rather than conventional internal combustion engines. These ships utilize onboard electric drive systems, which may be powered by batteries, fuel cells, or hybrid systems. Electric propulsion not only powers the main propellers but also energizes auxiliary systems and onboard equipment, enabling more efficient and compact marine vessel designs.

Historical Context and Evolution

While the concept of electric propulsion in ships is not entirely new, recent technological innovations have significantly revitalized interest in this domain. The global focus on reducing carbon footprints, coupled with increasing investment in green technologies, has pushed shipbuilders and operators to reconsider the role of electric propulsion in both short-haul and long-haul maritime applications.

Browse over XX market data Figures spread through XX Pages and an in-depth TOC on "Global Electric Ship Market.” @ https://www.techsciresearch.com/report/electric-ship-market/16489.html

Key Growth Drivers of the Electric Ship Market

- Environmental Sustainability and Regulatory Mandates

The maritime sector is under growing pressure to reduce its contribution to global greenhouse gas emissions. Electric ships, which emit zero direct emissions during operation, offer a compelling alternative to conventional ships. Regulatory bodies like the International Maritime Organization (IMO) have enacted stringent emissions mandates, especially in Emission Control Areas (ECAs), where sulfur and nitrogen oxide emissions are heavily restricted. In such regions, electric ships provide a seamless compliance pathway.

- Governmental Support and Incentives

Governments worldwide are promoting the adoption of electric propulsion in shipping through subsidies, tax incentives, and public-private partnerships. These policy instruments are designed to reduce initial capital costs and encourage research, development, and commercialization of clean marine technologies. Countries such as Norway, the Netherlands, Japan, and South Korea are leading in the deployment of electric ferries and port electrification initiatives.

Electric Ship Market Trends

Expansion into Larger Vessels and New Applications

Initially, electric propulsion systems found applications primarily in small vessels such as ferries, passenger boats, and recreational crafts. However, with improvements in battery density and range capabilities, electric propulsion is now being considered for larger vessels including offshore support vessels, research ships, and even container ships. This trend marks a significant turning point and indicates a wider market potential.

Emergence of Hybrid Propulsion Systems

Hybrid electric propulsion systems combine the efficiency of electric motors with the reliability of diesel or gas engines. These systems offer operational flexibility, enabling vessels to switch between power sources depending on voyage conditions. Hybrid configurations also allow for energy savings, reduced emissions, and extended operational range — a practical approach for long-distance maritime applications.

Rising Importance of Energy Management Systems (EMS)

Energy Management Systems play a vital role in optimizing energy use onboard electric ships. By monitoring power distribution to propulsion units, auxiliary systems, and onboard electronics, EMS help reduce wastage, improve battery life, and ensure efficient operation. Integration of intelligent EMS and automated controls is becoming increasingly common in advanced ship designs.

Technological Advancements

Batteries are the cornerstone of electric propulsion, and recent advancements in battery technology are revolutionizing the electric ship industry. Lithium-ion batteries currently dominate due to their high energy density, fast charging capability, and long life cycle. Innovations in solid-state batteries and lithium-sulfur technology promise even greater improvements in safety, range, and cost-efficiency. Moreover, manufacturers are developing marine-grade batteries that can withstand saltwater corrosion, extreme temperatures, and high mechanical vibrations.

In addition to batteries, hydrogen fuel cells are gaining traction as an alternative power source for electric ships. These systems convert hydrogen into electricity through electrochemical reactions, emitting only water vapor. Their suitability for longer voyages, high-power applications, and minimal environmental impact makes them a promising technology. Samsung Heavy Industries' 2022 development of a liquid hydrogen fuel cell system represents a major leap forward in this domain.

One of the key challenges facing the electric ship industry is the lack of adequate charging infrastructure. However, progress is being made with the development of high-capacity onboard chargers, shore power connections, and wireless charging technologies. Port electrification and the establishment of charging stations at key maritime hubs are expected to support market growth further.

Electric Ship Market Challenges

High Initial Costs

Despite long-term savings in fuel and maintenance, the high upfront cost of electric propulsion systems remains a deterrent for many ship owners and operators. Investment in batteries, EMS, and hybrid technologies requires significant capital, which can be a barrier, especially in developing regions with constrained budgets.

Limited Charging Infrastructure

The global maritime industry lacks a standardized and widely available charging network for electric ships. This limitation restricts the operational range of fully electric vessels and poses a challenge for long-haul shipping. However, ongoing investments in port electrification and smart grid integration are addressing this issue gradually.

Technical Limitations and Reliability Concerns

Operating in harsh maritime environments demands high levels of reliability from electric propulsion systems. Components such as batteries, fuel cells, and EMS must be capable of performing under saltwater exposure, high humidity, and fluctuating temperatures. Ensuring the reliability of electric systems over long periods without frequent maintenance remains a core challenge.

Key Recent Developments

Strategic Contracts and Partnerships

Kongsberg Gruppen secured a NOK 300 million (USD 30 million) contract in November 2022 to supply hybrid propulsion systems and permanent magnet thrusters for wind farm support vessels at Cochin Shipyard in India.

General Dynamics Electric Boat received a USD 37.3 million contract modification from the U.S. Navy, signifying growing military interest in electric marine propulsion.

Samsung Heavy Industries achieved preliminary certification from DNV for its liquid hydrogen fuel cell system, which utilizes both polymer and liquid hydrogen to generate propulsion electricity.

Segmentation Analysis of the Electric Ship Market

By Carriage Type

Passenger Vessels: Electric propulsion is rapidly gaining popularity in ferries, water taxis, and cruise boats due to zero-emission advantages in urban and tourism-focused regions.

Cargo Vessels: Electric and hybrid propulsion systems are being considered for container ships and bulk carriers, especially in port-to-port transportation and short sea shipping.

By Propulsion Type

Hybrid Electric Ships: Dominating due to their flexibility, especially for routes lacking consistent charging infrastructure.

Pure Electric Ships: Ideal for short-distance routes with established charging points, such as ferry lines and river cruises.

Competitive Landscape

Major companies operating in the global Electric Ship Market are:

- Vision Marine Technologies Inc.

- Grove Boats SA

- Ruban Bleu

- ElectraCraft Boats

- Greenline Yachts

- Domani Yachts

- Ganz Boats GmbH

- Quadrofoil

- Duffy Electric Boats

- Groupe Beneteau

Download Free Sample Report @ https://www.techsciresearch.com/sample-report.aspx?cid=16489

Customers can also request 10% free customization on this report.

Regional Insights

North America: With growing environmental regulations and port modernization initiatives, North America is witnessing increasing investment in electric ship technology. Government programs and naval electrification efforts are further bolstering the regional market.

Europe: Europe is at the forefront of electric ship adoption, especially in countries like Norway and the Netherlands. Strong governmental support, maritime innovation hubs, and a strong regulatory framework are contributing to rapid market growth.

Asia-Pacific: Asia-Pacific is emerging as a key market, driven by shipbuilding activities in countries such as China, South Korea, and Japan. India is also entering the electric ship segment through initiatives like those led by Cochin Shipyard.

Rest of the World: Latin America and the Middle East are gradually exploring electric marine transport as part of broader sustainability goals, although adoption rates remain comparatively low.

Future Outlook and Opportunities

The global electric ship market is expected to witness significant transformation and expansion over the coming years. Opportunities include:

Development of autonomous electric vessels for smart shipping.

Growth in retrofitting services to convert conventional ships into electric or hybrid ones.

Partnerships between shipbuilders and tech companies to develop integrated propulsion and energy systems.

Advancements in fuel cells and green hydrogen infrastructure are enabling longer operational ranges and sustainable power generation.

Conclusion

The global electric ship market is undergoing a paradigm shift, fueled by the urgent need to decarbonize the maritime industry and develop resilient, future-ready transport systems. Electric propulsion, once a niche innovation, is becoming a mainstream solution with applications across vessel types and geographies. Despite challenges related to infrastructure, cost, and technical limitations, the market is on a strong growth trajectory supported by favorable regulations, technological breakthroughs, and rising environmental awareness.

As stakeholders across the maritime value chain continue to prioritize sustainability, electric ships are poised to play a transformative role in shaping the future of global shipping.

You may also read:

Passenger Car Automatic Transmission Market Trends, Key Players, and {6.9%} CAGR Forecast

Passenger Cars Shared Mobility Market: USD 93 Billion Valuation & {10.7%} CAGR – Key [Trends] & Insights

Automotive Automatic Transmission Market Share and Growth Forecast with {4.5%} CAGR

High Performance Passenger Car Tire Market Overview: USD 38.5 Billion and Projected {6.7}% CAGR Growth

Passenger Car Anti-Fog Lights Market Analysis: Projected Growth at [12.8% CAGR]

More Posts

Report This Post

Please complete the following requested information to flag this post and report abuse, or offensive content. Your report will be reviewed within 24 hours. We will take appropriate action as described in Findit terms of use.