Right Now

Electric Vehicle Connector Market Demands: [USD 85 Million, Latest Market Report]

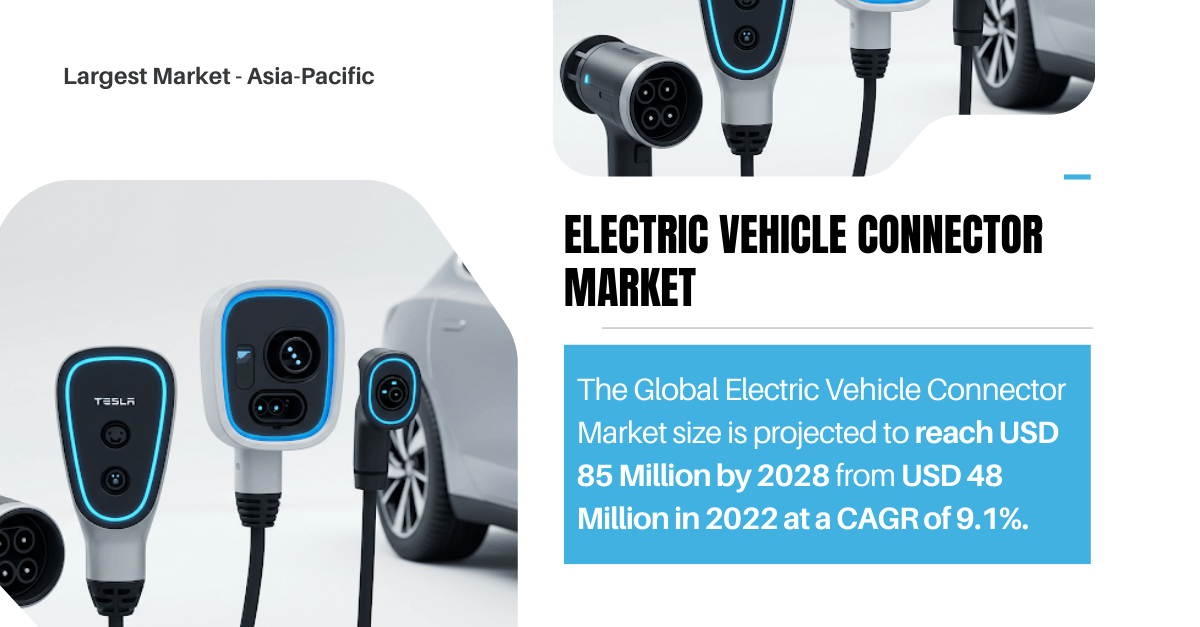

The global electric vehicle (EV) connector market stood at USD 48 million in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 9.1% during the forecast period from 2024 to 2028. This expansion is driven by the rising adoption of electric vehicles globally, evolving charging infrastructure, continuous technological advancements, and the increased popularity of shared mobility services. EV connectors serve as the essential link between electric vehicles and charging stations, playing a pivotal role in ensuring energy transfer efficiency and operational safety.

As governments and industries around the world commit to reducing greenhouse gas emissions, the EV sector is undergoing a major transformation. EV connectors are at the heart of this transformation, enabling seamless charging and supporting the transition to clean transportation. This report delves into the core dynamics of the EV connector market, examining key growth factors, regional insights, technology trends, and challenges impacting the market.

Electric Vehicle Connector Market Overview

- Importance of EV Connectors

Electric vehicle connectors are vital components that ensure the smooth transmission of electricity from the power grid to the electric vehicle battery. As the volume and variety of electric vehicles increase, the role of reliable and compatible EV connectors becomes more significant in maintaining user convenience and driving further adoption.

Connectors come in different designs, charging levels, and protocols based on region and vehicle type. With the global shift toward electrified transportation, the design and deployment of connector systems are increasingly governed by considerations of speed, efficiency, safety, and universal compatibility.

Browse over XX market data Figures spread through XX Pages and an in-depth TOC on "Electric Vehicle Connector Market.” @ https://www.techsciresearch.com/report/electric-vehicle-connector-market/3772.html

- Rising Demand for Electric Vehicles

The sharp rise in EV sales is the primary driver of connector demand. With environmental sustainability becoming a critical policy and consumer agenda, both developed and emerging markets are seeing increased investment in electric mobility. Regulatory mandates such as emissions caps, zero-emission zones, and financial incentives for EV buyers are accelerating this trend.

Technological Advancements Driving Market Growth

Fast Charging Technologies

One of the significant technological developments in the EV connector market is the move toward fast charging. Traditional connectors used for Level 1 and Level 2 AC charging are being complemented or replaced by Level 3 DC fast chargers. These connectors support significantly higher power levels and can charge an EV battery in under an hour, reducing downtime and enhancing practicality for commercial and fleet users.

Evolving Connector Standards

Industry-wide efforts to standardize connectors have led to the dominance of formats such as Type 2 connectors (widely used in Europe) and Combined Charging System (CCS), which supports both AC and DC charging. CHAdeMO connectors, originally popular in Japan, also continue to see use in various global markets. The ongoing refinement of these connector standards is making it easier for EV owners to charge their vehicles across different networks and regions.

Integration of Smart and Connected Features

Modern EV connectors are increasingly embedded with sensors and software capabilities that allow for smart charging management. This includes features like dynamic load balancing, energy metering, remote diagnostics, and communication with grid management systems. These smart connectors not only enhance user experience but also contribute to grid stability and energy efficiency.

Charging Infrastructure Development

The growth of charging infrastructure, particularly fast-charging stations, is critical to EV adoption. Urban centers, highways, workplaces, and residential complexes are all undergoing infrastructure upgrades to accommodate the increasing number of electric vehicles.

Governments and private players are working together to deploy EV charging networks at scale, with particular emphasis on reducing range anxiety and making long-distance EV travel viable. EV connectors, particularly those used in fast-charging stations, draw significant amounts of power from the grid. This necessitates parallel investments in grid capacity and stability to ensure consistent power delivery. Advanced connectors designed to operate with high voltages and currents are being deployed alongside these upgrades, making the entire EV charging ecosystem more robust.

Shared Mobility and Fleet Electrification

Rise in Electrified Shared Mobility Solutions

Shared mobility services—such as ride-hailing, car-sharing, and electric taxis—are increasingly shifting to electric vehicles. These services typically operate in high-utilization environments, where vehicle downtime due to charging must be minimized. Consequently, there is strong demand for EV connectors that support high-speed, durable, and frequently used charging interfaces.

Demand for Operational Efficiency

Fleet operators are looking for integrated EV charging solutions that include fast-charging connectors, intelligent energy monitoring, and predictive maintenance capabilities. This ensures that electric fleets can be efficiently managed and remain available for service with minimal disruption.

Regional Electric Vehicle Connector Market Analysis

The North American market is witnessing steady growth in EV connector demand, led by initiatives such as the U.S. federal government’s commitment to developing a nationwide EV charging network. States like California, New York, and Washington have implemented aggressive targets for vehicle electrification, prompting infrastructure investments and supporting connector standardization efforts.

Europe is a leader in the EV revolution, with strong policy support and widespread adoption of zero-emission vehicles. Stringent emission regulations and incentives for EV buyers have propelled the growth of EV connector infrastructure. Countries like Germany, the Netherlands, Norway, and the United Kingdom are at the forefront, with highly developed charging networks supporting public, private, and fleet users.

Asia-Pacific, particularly China, is emerging as the largest market for EV connectors. Government-led initiatives to reduce urban pollution and promote green transport, coupled with the presence of leading EV manufacturers, have resulted in significant investments in EV infrastructure. India, South Korea, and Japan are also investing in public charging infrastructure and fast-charging corridors, further boosting demand for advanced connector technologies.

In Latin America, the Middle East, and parts of Africa, EV adoption is at a nascent stage. However, market prospects are promising due to increasing urbanization, growing awareness of clean mobility, and early-stage government initiatives. These regions are likely to adopt cost-effective and scalable EV connector solutions suited to their infrastructural limitations.

Challenges and Restraints

High Installation and Equipment Costs

One of the prominent challenges in the EV connector market is the high cost associated with establishing and maintaining fast-charging infrastructure. These costs include the connectors themselves, installation, electrical upgrades, and ongoing maintenance, making it a capital-intensive venture for both governments and private players.

Lack of Global Standardization

The absence of a globally unified standard for EV connectors has led to market fragmentation. Different regions and automakers use varied connector types, leading to compatibility issues. This restricts seamless charging across networks and hinders the scalability of universal charging solutions.

Supply Chain Vulnerabilities

The EV connector market, like the broader EV ecosystem, is sensitive to supply chain disruptions. Delays in the procurement of raw materials, electronic components, and manufacturing equipment can lead to production slowdowns and affect market growth.

Competitive Landscape

The global EV connector market is characterized by technological innovation and strategic partnerships. Leading players are focused on developing next-generation connectors that offer faster charging, improved safety, and compatibility with emerging energy management systems.

Major companies operating in the Global Electric Vehicle Connector Market are:

- TE Connectivity

- Robert Bosch GmbH

- Siemens

- TESLA INC

- Fujikura Ltd.

- HUBER+SUHNER

- YAZAKI Corporation

- Sumitomo Corporation

- Schneider Electric

Download Free Sample Report @ https://www.techsciresearch.com/sample-report.aspx?cid=3772

Customers can also request 10% free customization on this report.

Recent Strategic Developments

In 2023, Siemens Smart Infrastructure partnered with ENGIE Vianeo to roll out cutting-edge EV charging stations, leveraging smart grid capabilities and rapid charging technologies.

In 2022, Bosch collaborated with Blink Charging Co., becoming the official EV charger supplier for General Motors dealerships in Mexico, marking a significant step toward integrated EV infrastructure.

Opportunities for Growth

As developing countries improve urban planning and energy infrastructure, there is significant potential for EV connector manufacturers to penetrate these markets with cost-effective and adaptable solutions. The intersection of EV charging and renewable energy is opening new avenues for growth. EV connectors designed to operate with solar and wind energy systems enable cleaner charging options and reduce dependence on fossil fuel-based power grids.

The rise of autonomous electric vehicles is leading to the exploration of automated and wireless charging solutions. Future connectors may incorporate robotic arms or induction-based systems, eliminating the need for manual intervention and further enhancing user convenience.

Strategic Recommendations

To thrive in a rapidly evolving market, companies must focus on innovation, interoperability, and strategic collaboration. Investing in standardization efforts, developing scalable product lines, and enhancing smart charging features are essential. Equally important is building robust supply chains and engaging with policymakers to shape favorable regulations.

Firms should also expand their presence in emerging markets, where early investment can lead to long-term competitive advantage. Providing comprehensive charging solutions—including connectors, software platforms, and maintenance services—will be key to capturing a larger market share.

Conclusion

The global electric vehicle connector market is undergoing a transformative phase, powered by the broader transition toward sustainable transportation. The increasing adoption of electric vehicles, rising investment in infrastructure, and continuous innovation in connector technology are aligning to create robust growth opportunities.

Despite challenges such as high costs and the lack of standardization, the outlook remains positive. Market participants that invest in future-proof technologies, contribute to setting global standards, and expand across geographies are well-positioned to lead in this dynamic sector.

As the electric mobility revolution accelerates, EV connectors will remain a foundational element in enabling a cleaner, more efficient, and interconnected transportation system.

You may also read:

Automotive Light Bars Market Forecast: [7.9% CAGR [Growth]] – [USD 18 Billion Valuation]

Automotive Wiping Systems Market Forecast: [7.3% CAGR and Detailed Size Analysis]

Automotive Cooling Fan Market Report: [3.7%+ CAGR, Share, Demand & Player Analysis]

Electric Vehicle Components Market Forecast: [Robust 12.5% CAGR, USD 305 Billion Base, Future Market Size]

Automotive Navigation System Market Share: [Driving USD 45 Billion [Growth] | Latest Report & Key Demands]

More Posts

Report This Post

Please complete the following requested information to flag this post and report abuse, or offensive content. Your report will be reviewed within 24 hours. We will take appropriate action as described in Findit terms of use.