Right Now

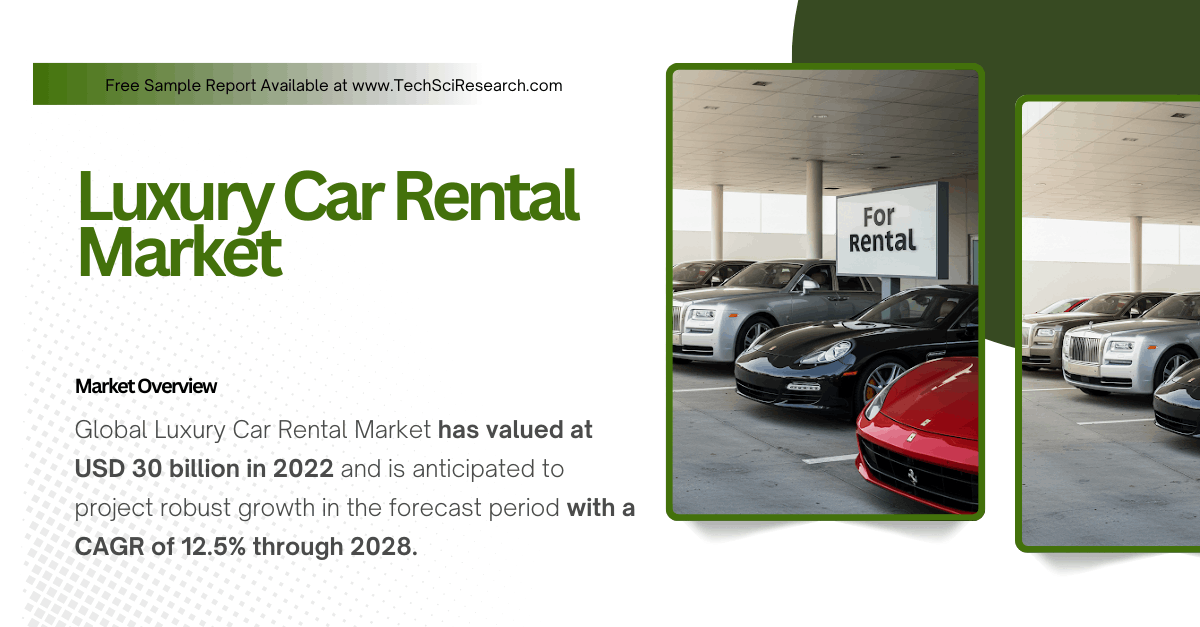

Luxury Car Rental Market Forecast: Strong [Growth] Ahead with a [12.5% CAGR]

The luxury car rental market is a fast-evolving segment within the broader automotive leasing industry. According to TechSci Research’s report, “Luxury Car Rental Market – Global Industry Size, Share, Trends, Competition Forecast & Opportunities, 2028,” the market was valued at USD 30 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 12.5% during the forecast period of 2024 to 2028. Luxury car rentals refer to the temporary leasing of high-end, premium vehicles that offer a superior level of performance, comfort, aesthetics, and technological integration.

This segment is rapidly gaining popularity due to changes in consumer behavior, a growing demand for high-end experiences, and an increasing emphasis on convenience over ownership.

Luxury Car Rental Market Definition and Scope

Luxury car rental encompasses the short- to long-term leasing of premium vehicles such as those manufactured by brands like Mercedes-Benz, BMW, Audi, Porsche, Jaguar, and others. These vehicles are typically rented out by businesses or individuals for purposes such as business travel, leisure, events, or showcasing prestige.

The rental period can vary from a few hours to several weeks and is often associated with value-added services such as chauffeur-driven options, concierge support, and inclusive maintenance packages.

Key Growth Drivers of the Luxury Car Rental Market

- Rising Demand for Premium Experiences

The global rise in disposable incomes and the evolving lifestyle aspirations of consumers have led to a growing appetite for premium experiences. Renting a luxury car allows consumers to enjoy a high-end lifestyle without the burdens of ownership, such as maintenance and depreciation.

- Urbanization and Increasing Travel Activity

As urban populations grow and international tourism rebounds, the demand for luxury vehicles—particularly for business and leisure travel, has surged. High-net-worth individuals and professionals are increasingly seeking mobility solutions that align with their status and offer convenience.

Browse over XX market data Figures spread through XX Pages and an in-depth TOC on "Global Luxury Car Rental Market.” @ https://www.techsciresearch.com/report/luxury-car-rental-market/16298.html

- Shifting Consumer Preferences

Modern consumers, especially millennials and Gen Z, are leaning toward “access over ownership.” For many, experiences are prioritized over long-term possessions. This shift is especially evident in the luxury segment, where temporary access to a prestigious vehicle is more appealing than permanent ownership.

- Cost Benefits and Flexible Payment Structures

Leasing high-end cars eliminates the need for significant capital outlay and reduces exposure to depreciation. Luxury rentals offer manageable monthly payments, flexible leasing periods, and bundled service packages, enhancing the affordability and appeal for both individuals and corporate clients.

Luxury Car Rental Market Segmentation

By Rental Type: Business vs. Leisure

Business Rental: Companies often lease luxury cars to maintain a premium brand image or for executive mobility. This segment benefits from bulk leasing, long-term arrangements, and tailored fleet management services.

Leisure Rental: Individuals rent luxury cars for weddings, vacations, or other social events. The leisure segment often sees demand for shorter durations but commands premium pricing due to its experience-focused nature.

By Booking Type: Online vs. Offline

Online Booking: The integration of digital platforms has revolutionized the luxury car rental experience. From mobile apps to websites, customers can now reserve premium cars instantly with options to select features, customize duration, and access add-ons.

Offline Booking: Despite digital growth, a portion of customers, especially corporate clients, still prefer face-to-face arrangements, especially when custom agreements and verification are required.

By End User: Self-Driven vs. Chauffeur-Driven

Self-Driven: A growing category among experienced drivers who prefer to enjoy the luxury vehicle personally. This option allows renters full control of their travel schedule and itinerary.

Chauffeur-Driven: Often preferred for events or business use, chauffeur services enhance comfort, reduce travel fatigue, and present an elevated image. These services are particularly in demand in high-profile events and VIP transportation.

Regional Insights of the Luxury Car Rental Market

North America represents one of the largest markets due to a high concentration of affluent individuals, established infrastructure, and a mature car rental ecosystem. The United States, in particular, has seen rapid adoption in cities like Los Angeles, Miami, and New York, driven by a blend of celebrity culture and business travel.

Europe’s historical association with premium automobiles and affluent tourists drives demand in cities such as London, Paris, Berlin, and Milan. The continent also hosts numerous luxury car manufacturers, making it an important player in the supply side of the market.

Emerging economies such as China, India, and Southeast Asian nations have seen a significant uptick in luxury car rentals, fueled by economic growth, urbanization, and the rise of a wealthy middle class. Markets like Japan and South Korea are also contributing, particularly in tech-savvy and convenience-focused cities.

Luxury car rental is especially prominent in the Gulf countries, where opulence and high-end lifestyle are deeply ingrained. Dubai and Abu Dhabi are key hubs where luxury car rental businesses thrive among locals, expatriates, and tourists.

Although still developing, luxury car rentals in countries like Brazil, Mexico, and Chile are gaining ground as consumer spending increases and tourism expands.

Luxury Car Rental Market Trends

Emergence of Electric Luxury Vehicles

The luxury automotive segment is transitioning toward electrification. Electric models like the Tesla Model S, Porsche Taycan, and BMW iX are now available in premium rental fleets. These vehicles align with growing environmental awareness among customers and contribute to reduced carbon footprints.

Customization and Subscription Services

Customers increasingly seek tailored rental experiences. As a result, companies offer personalized packages, subscription-based services, and exclusive vehicle swaps within specific periods. These models enhance engagement and customer retention.

Integration of Advanced Technology

Luxury rentals are incorporating AI-based concierge services, real-time vehicle tracking, remote diagnostics, and mobile-first bookings. These technological enhancements are redefining the customer journey and raising service standards.

Strategic Collaborations and Expansion

Companies are forming alliances with five-star hotels, travel agencies, and airlines to create value-added packages. For example, Starr Premium’s expansion into U.S. cities and its tie-ups with luxury hospitality brands highlight the increasing convergence of travel and luxury transportation.

Challenges and Restraints

Luxury vehicles require frequent maintenance, premium spare parts, and specialized servicing. These factors significantly increase operational costs for rental companies and impact profitability if fleet utilization is not optimized. Government policies on emissions, taxation, and import duties can affect the luxury vehicle rental business. Stricter emission standards in regions like Europe compel companies to renew fleets regularly, adding financial pressure.

In emerging markets, the lack of reliable charging infrastructure poses a hurdle for electric luxury vehicle rentals. The absence of fast-charging networks limits route flexibility and customer confidence in renting EVs.

High-value vehicles carry higher insurance premiums, and accidental damages can result in significant liabilities. Rental firms must strike a balance between customer satisfaction and risk mitigation through comprehensive insurance coverage and security protocols.

Competitive Landscape

Major Players

Avis Budget Group

Sixt SE

Enterprise Holdings

Hertz Global Holdings

Movida Participações

Localiza

Europcar Mobility Group

Unidas

Car Inc.

Goldcar

These companies operate across various regions and offer diverse fleets, often differentiated by their customer experience, technology adoption, and brand partnerships.

Download Free Sample Report @ https://www.techsciresearch.com/sample-report.aspx?cid=16298

Customers can also request for 10% free customization on this report.

Startups and Niche Operators

New entrants and boutique providers like Starr Luxury are carving out space with specialized offerings. These firms cater to ultra-luxury clientele, focus on exceptional service delivery, and often partner with premium lifestyle brands to strengthen their market presence.

Notable Developments

Starr Premium’s Entry into the U.S. (2022): Expanded into cities including Los Angeles, Atlanta, and Miami, with collaborations involving luxury hotels.

Uber Comfort Electric (2022): Rolled out in cities such as Las Vegas, Seattle, and Austin, introducing premium EV rentals.

Ajman Transport Authority’s Rental Integration (2021): Part of UAE Vision 2021, aimed at offering equitable transportation solutions, including luxury rentals for federal use.

Future Outlook

Market Forecast

By 2028, the global luxury car rental market is projected to exceed USD 60 billion, propelled by technological advancements, greater environmental consciousness, and evolving customer expectations. Companies that focus on electrification, personalization, and digital transformation are likely to dominate.

Strategic Recommendations

Fleet Electrification: Invest in EVs and expand access to charging stations.

Digital Transformation: Enhance mobile platforms, AI services, and contactless booking systems.

Customer Experience: Focus on white-glove services, loyalty programs, and customizable packages.

Geographic Expansion: Explore untapped markets in Africa and Southeast Asia with rising affluence.

Conclusion

The global luxury car rental market represents a dynamic and expanding niche in the mobility ecosystem. Driven by a shift toward experience-based consumption, rising wealth levels, and growing corporate demand, this segment offers lucrative opportunities. By aligning with trends such as sustainability, technology integration, and personalized services, market players can tap into a growing customer base that values prestige, performance, and flexibility.

As ownership models evolve and the line between transportation and lifestyle continues to blur, luxury car rental services will increasingly become an integral part of the global automotive landscape.

You may also read:

Shared Mobility Market [Growth] Analysis: [USD 163 Billion] Value and [14.7% CAGR] Expected

Automotive Horn Systems Market Overview: Key Players, Trends, and [8.8% CAGR] Forecast

Automotive Active Purge Pump Market Size & [Growth] Forecast: [USD 2.8 Billion] and [6.2% CAGR]

Automotive Aerodynamic Market Overview: USD 27 Billion Valuation with [8.7%] CAGR [Growth] Forecast

Automotive Exhaust Aftertreatment Systems Market Forecast: Key Players, Trends, and [13.3%] [Growth]

More Posts

Report This Post

Please complete the following requested information to flag this post and report abuse, or offensive content. Your report will be reviewed within 24 hours. We will take appropriate action as described in Findit terms of use.